Franklin Templeton’s Voice of the American Worker study, now in its third year, uncovered some interesting new trends and also a reversal in others that had taken root during the COVID-19 lockdown period. One thing that’s clear is workers today are feeling more financial stress and concern, which also has implications for employers.

The Voice of the American Worker annual survey, conducted by The Harris Poll on behalf of Franklin Templeton, is connected to Franklin Templeton’s Retirement Innovation Initiative (RII), which launched in January 2020. RII’s mission is to bring together industry experts who share the same vision—improving the future of retirement in the United States. The survey respondents represent a snapshot of the US workforce: across the country, across industry, and across generations and backgrounds.

The Voice of the American Worker annual survey, conducted by The Harris Poll on behalf of Franklin Templeton, is connected to Franklin Templeton’s Retirement Innovation Initiative (RII), which launched in January 2020. RII’s mission is to bring together industry experts who share the same vision—improving the future of retirement in the United States. The survey respondents represent a snapshot of the US workforce: across the country, across industry, and across generations and backgrounds.

Throughout the last three years, some evergreen trends have been reconfirmed year over year:

- Workers continue to seek improved well-being and need support in addressing existing roadblocks.

- A focus on well-being continues to include urgency in improving financial health with key opportunities for employer support.

- Workers remain more focused on financial independence than traditional retirement.

- There has never been a more urgent time for employers to evaluate their benefit offerings and consider ways to evolve how employee needs are supported.

Financial independence remains a top priority.

If financial independence is defined as “having enough income or wealth sufficient to pay one’s living expenses without having to be employed or dependent on others”, the path to achieving financial independence will not look the same for everyone.

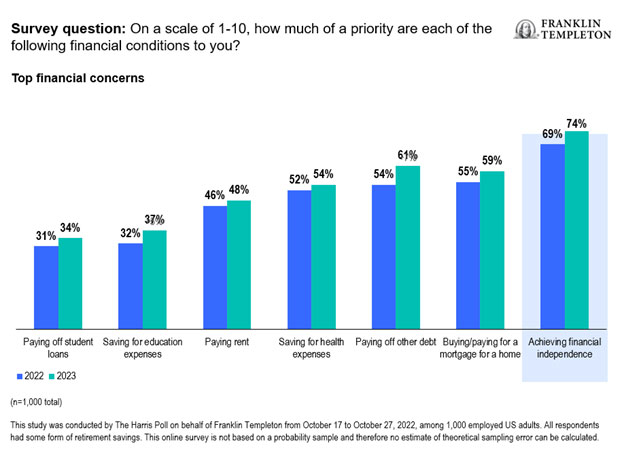

Survey finding: All in all, regardless of the current economic or workforce environment, employees continue to view financial independence as their primary north star. This year, 74% stated financial independence is their top financial concern, up from 69% in last year’s study. In addition, 81% of respondents said they are more focused on becoming financially independent. Among other concerns, the next most important was paying off debt (61%), which was up 7% since last year. That is not surprising given that US credit card debt levels just hit a 20-year high.

Action item for employers: We as an industry and employers have a key opportunity to engage employees across the full spectrum of financial aspects and provide holistic support in helping employees reach financial independence. Three-quarters (77%) of survey respondents said they’d be more likely to participate or contribute more to their retirement savings if there were more personalized 401(k) investment options, and they are seeking access to advice. They want access to a financial advisor, they want auto-enrollment, tax guidance, budgeting and debt guidance.

The Voice of the American Worker study was conducted by The Harris Poll on behalf of Franklin Templeton from October 17 to October 27, 2022, among 1,000 employed U.S. adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed U.S. adults, and findings from 2021 reference a similar survey conducted among 1,005 employed adults from October 28 to November 15, 2021.Franklin Templeton is not affiliated with The Harris Poll, Harris Insights & Analytics, a Stagwell LLC Company.

For additional information, please contact the Franklin Templeton Workplace Retirement team at (800) 342-5236, or visit https://www.franklintempleton.com/insights/research-findings/voice-of-the-american-worker-survey.

IMPORANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the author and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this presentation has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Franklin Distributors, LLC. Member FINRA/SIPC. Prior to July 7, 2021, Franklin Templeton Distributors, Inc., and Legg Mason Investor Services, LLC served as mutual fund distributors for Franklin Templeton.