TIME

TO TAKE

A CLOSER

LOOK AT

MANAGED

ACCOUNTS

Why You Would Benefit From a Committee Discussion of In-Plan Managed Accounts

Managed accounts offer a variety of potential benefits, including greater personalization of retirement accounts, the ability to address individual needs, create more appropriate asset allocation, increase overall diversification, and boost plan participation and contribution rates. On the other hand, concerns and drawbacks must be addressed, including higher costs, a lack of relevant benchmarks, and questions as to how best to present managed accounts.

SO, WHAT SHOULD YOU WATCH FOR IN CONSIDERING MANAGED ACCOUNTS?

The PPA set the stage in 2006

Passage of the Pension Protection Act of 2006 (PPA) was a pivotal moment in the history of defined contribution (DC) plans. Among other things, the PPA provided fiduciary protection for plan sponsors and advisors through the creation of qualified default investment alternatives (QDIAs).

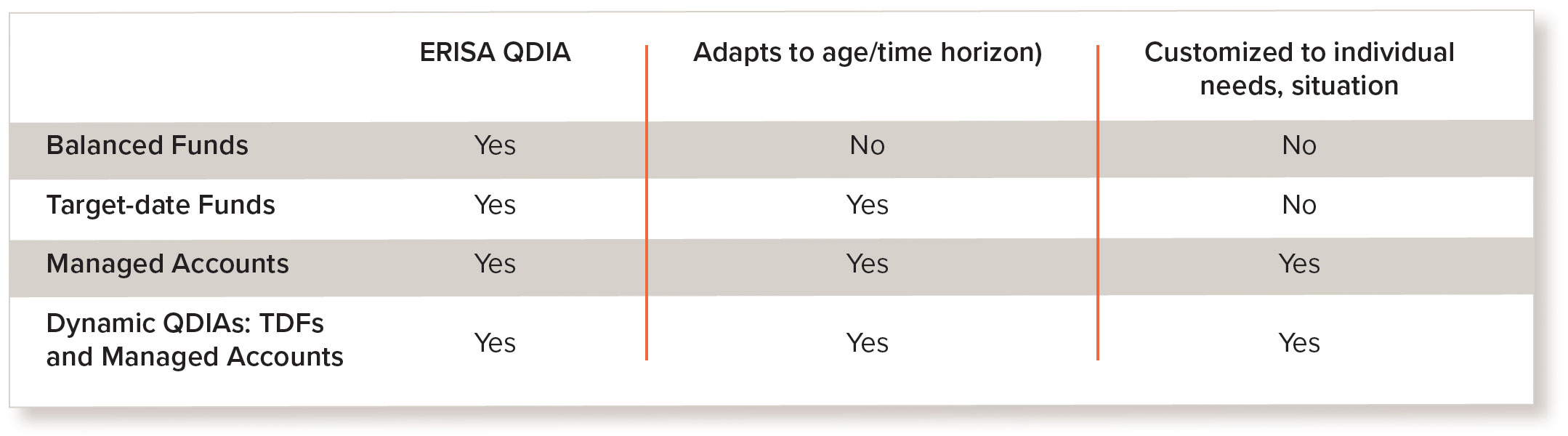

Further to that, the Department of Labor defined QDIAs as one of three types of investments: target-date funds, balanced funds, and managed accounts. Of these three, target-date funds have taken off in popularity, and are being used as a QDIA by almost four in five defined contribution (DC) plans, with less than one-tenth managed accounts and balanced.

Although managed accounts haven’t really achieved widespread usage, we believe that it’s now time to take a closer look at them. In brief, managed accounts are accessible, powerful tools that can personalize and customize retirement solutions for many plan participants, possibly leading to measurably better long-term financial outcomes. However, questions remain regarding how managed accounts are implemented and how they can be optimized for the greatest employee benefit.

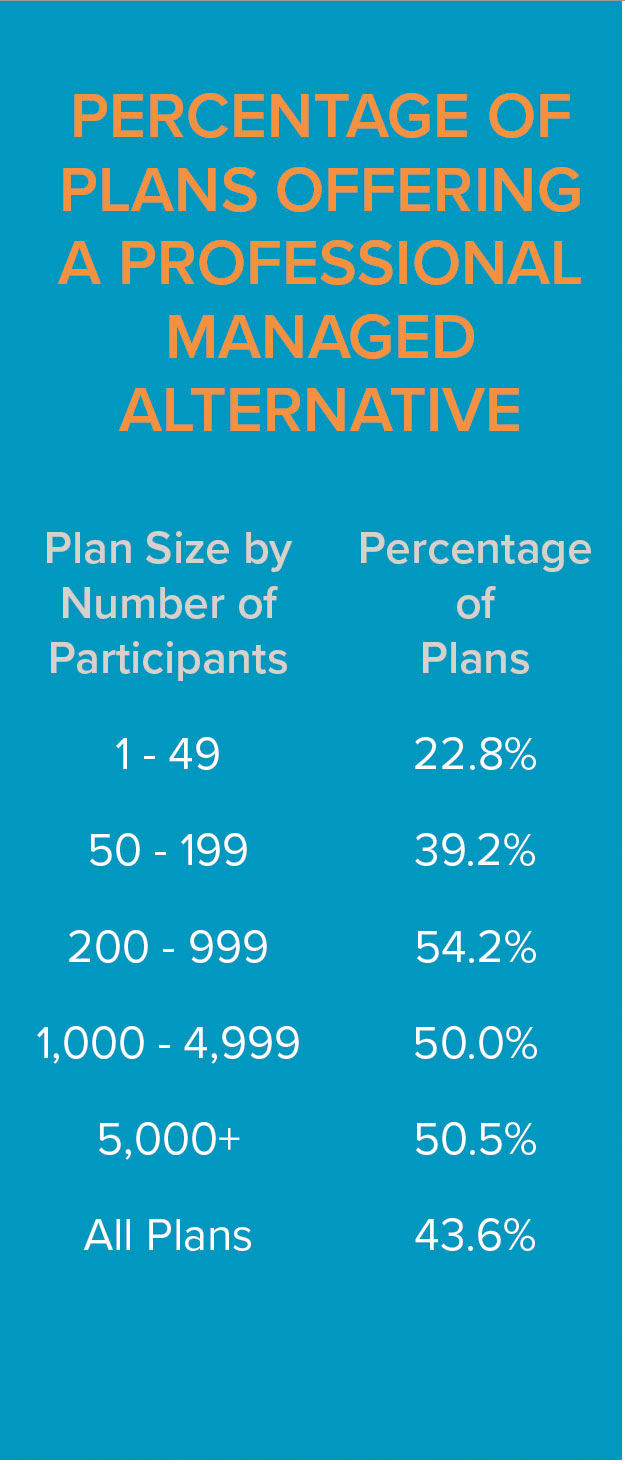

Source: PSCA’s 2020 63rd Annual Survey of Profit Sharing and 401(k) Plans

What Are Managed Accounts?

Managed accounts are professionally managed and personalized portfolios that address the needs, preferences, risk tolerance, and situation of an individual DC plan participant. Managed accounts can also be monitored daily and rebalanced regularly with the goal of ensuring the individual participant enrolled in the account achieves retirement readiness.

They qualify as a QDIA under the Employee Retirement Income Security Act (ERISA) but can also be used within a DC plan as one of a number of investment choices, without being the default

investment. They can also be used in conjunction with target-date funds as a combined QDIA.

What Has Hindered Wider Usage?

Managed accounts generally charge a fee separate from the investment management fees charged by underlying investment funds. That alone might make some plan sponsors reluctant to use them as an investment option or as a QDIA. There might be uncertainty or unease over fiduciary liabilities if a plan places participants into a higher-cost investment. Ultimately, however, the questions of value and net returns are more important than cost alone.

A more thorough fiduciary analysis of cost versus value is necessary before dismissing managed accounts as too costly. The key question from a fiduciary perspective is: Is it in the participants’ best interest to be given the option of using a managed account in their 401(k)? While costing more, it could have the net overall benefit of higher returns and/or more appropriate asset allocation and ultimately improved retirement outcomes.

Managed accounts are a relatively new offering for retirement plans, mostly adopted within the past decade. Further, managed accounts have continually evolved over time. That lack of a track record has until now been a hurdle blocking the wider usage and appreciation of managed accounts. However, significant changes to managed accounts in recent years mean the topic warrants review. A managed account is the most personalized account a participant can choose through the recordkeeping system.

What Has Changed?

In recent years, several developments have led retirement plan advisors and sponsors to reconsider and look more closely at managed accounts. These include:

- Costs trending lower.

- Improvements in technology and data collection leading to better access to participant information.

- Greater emphasis on more holistic financial well-being.

- Deeper appreciation for actions that plan fiduciaries can take at the plan level in support of plan participant outcomes.

- Managed accounts can be customized even without the participant’s input. Several platforms now automatically extract a variety of participant-level data from recordkeeping systems. However, that customization is more complete and effective with active input from participants, leading to improved outcomes.

- For optimal results, participants use interactive online tools to help estimate retirement income and consider their entire financial picture. For example, they may enter information from external investment accounts and other assets outside of their work-sponsored retirement plan, their estimated Social Security benefits, their level of risk tolerance, planned retirement age, estimated life expectancy, health information, number of dependents, their spouse’s retirement and saving information, and other relevant data.

- Costs of managed accounts are lower now, in part because of the use of technology. The ability to

access and apply data through automation makes the managed account process more streamlined and more time-efficient on the part of an advisor as well as the managed account provider, resulting in lower and more reasonable costs. A scan of the market by Council members found fees varying between 0.05% and 0.80%. Morningstar Research has found average fees at about 0.40% with a common range of 0.35% to 0.50%.1 The same managed account model could be available at various price points. Therefore, plan sponsors should consult with their plan advisor tounderstand the trade-off between service and cost that could influence their fiduciary decision. - A clearer understanding of fiduciary protection and obligation by plan fiduciaries, including sponsors and their advisors. In recent years, various ERISA litigations have clarified fiduciary responsibilities, obligations, and standards. That applies broadly but also specifically to managed accounts and their usage and role in supporting improved retirement readiness.

- Greater availability of managed accounts by numerous providers, leading to greater competition, and improved affordability and acceptance.

As a result, managed accounts have increased in popularity over the past decade or so. In 2009, roughly one in four DC plans provided a managed account option. However, by 2020, more than half of DC plans with at least 200 participants offered a professionally managed option within their plan, according to findings in the Plan Sponsor Council of America 64th annual survey.

This rising popularity is reflected by a stated receptiveness on the part of employees, as revealed in the findings of Franklin Templeton’s “Voice of the American Worker Survey.”2

THE SURVEY FOUND THAT:

Improve well being:

As employees seek opportunities to improve well being, most are interested in benefits such as access to a financial professional (56%), financial planning tools (62%) and financial education (54%).

How Can Managed Accounts Be Made Even Better?

As good as managed accounts are – and they have come a long way in a fairly brief period – they can be improved further so as to take best advantage of today’s technology and be used more extensively and effectively.

THESE FIVE STEPS CAN HELP MAKE BETTER USE OF MANAGED ACCOUNTS:

- Develop a more comprehensive view of participant assets, incorporating external data: The most effective financial planning is done with a holistic view of the client’s entire portfolio and other pertinent personal information, which can include spousal data.

- Increase personalization by making it easier for participants to engage and input their information: Although streamlined access to comprehensive participant data could reduce the need for participants to input more pertinent information, the more personal and financial data that users provide, the more complete, accurate, and effective the managed account platform can be, offering better guidance for individual users.

- Reduce the need for participant input: Keeping in mind the above point, inertia will prevent participants from taking the time to provide all their relevant financial information. Collecting more detailed participant information from the plan sponsor or the retirement plan service provider will encourage a better end-result for disengaged or less involved users. One option is to collect some information from payroll feeds.

- Promote better understanding and use of managed accounts by participants: To get participants to make better use of managed accounts, promote, communicate, encourage, and raise awareness and understanding of this valuable tool.

- Help advisors to understand and apply managed account technology better: It’s not just participants and plan sponsors who need to understand and appreciate the value and benefit of managed accounts. Plan advisors should be as familiar as possible with the platform and its technology to maximize the use and benefit derived from managed accounts.

How do Managed Accounts Mesh With Fiduciary Responsibilities?

Plan sponsors have “fiduciary protections for the investment services for the investment services of investment managers, so long as (they) prudently select and monitor the investment managers,” according to Fred Reish, JD, a well-known and prominent ERISA attorney, who specializes in fiduciary responsibility. “This is sometimes referred to as a 3(38) “safe harbor.”3

To qualify for fiduciary protection, therefore, the onus is on plan sponsors to prudently select and monitor providers and to document the results through committee minutes or other official records.

In selecting managed account providers, critical questions include:

- How are participant allocations determined?

- Does that comply with fiduciary principles?

- Does this reasonably reflect the needs and circumstances of each participant?

- What is the cost of the service?

- How are costs and performance benchmarked?

- Are investment expenses and account management fees reasonable?

- Are the services easy for participants to access and use?

In addressing these questions, the fiduciary process involves evaluating cost, but it’s fundamentally important to consider cost in light of value received. The notion of fiduciary risk is too often mistakenly associated with selecting a low-cost option. That is not at the heart of ERISA concerns. Following a prudent and thoughtful process is, in which, as Fred Reish points out, ”the analysis turn to value.”4

Following a prudent and thoughtful process is, in which, as Fred Reish points out, “the analysis turns to value.”4 “In that case,” he notes, “the managed account services should be designed to provide value to participants that equals or exceeds the cost differential.”

“The managed account

services should be

designed to provide

value to participants

that equals or exceeds

the cost differential.”

- FRED REISH, JD

Performance benchmarks are an inherent challenge with managed accounts, which are highly individual and customized. It is not the purpose of a managed account to outperform an index but rather to address individual needs and concerns and to help participants achieve a state of retirement readiness. Aside from concerns over the risks of including managed accounts in a DC plan, there are risks to plan participants if they don’t have such an option.

Plan sponsor concern for the protection and privacy of, and access to participant data is on the rise as cybercrime becomes commonplace. Increases with the scope and amount of data collected to support managed accounts. Implementing managed accounts necessarily entails manager access to personal information about individual participants– advisor or service provider. Plan fiduciaries would do well to document rules of engagement regarding uses of this rich data for purposes other than delivering managed account service.

How do Managed Accounts Compare With Balanced Funds and Target-Date Funds?

Considerations

As promising as managed accounts are, there remain numerous considerations to evaluate. First, a variety of managed accounts exist, with varying levels of advice and degrees of personalization provided. These include accounts managed by an advisor, the plan recordkeeper, or a third party. Some managed accounts provide one-on-one in-person service while others rely on a less expensive and more basic digital tool.

Personalization comes in different degrees. Passive personalization relies on the automatic capture of data regarding the participant while active personalization involves the participant actively providing personal information, including outside (non-plan) assets, for a more complete picture.

As noted earlier, managed accounts could be implemented as the DC plan’s QDIA, as part of a dynamic QDIA, or as an entirely optional choice, in which the individual participant takes the initiative to opt in. Performance benchmarks are an inherent challenge as the nature of managed accounts is highly individual and customized. Imperfect substitutes can be provided as a benchmark, such as using the performance of a target-date fund family offered as a default investment in the plan, with index performance weighted. However, the main focus of managed accounts isn’t to outperform an index but rather to address individual needs and concerns and to aide in plan participant retirement readiness.

Managed accounts remain a relatively new and increasingly popular and accepted option for plan sponsors to consider. They can be particularly appropriate and helpful for participants who seek more individualized attention. They can be highly useful as employees near the transition into retirement and seek more flexible, dynamic, and customized solutions.

Discussing managed accounts in a committee meeting could help plan sponsors with a heterogeneous workforce exercise their fiduciary responsibilities. We encourage sponsors to explore this option and to determine whether providing it will serve the needs of their plan participants.

About The Council

About The Council

The Council advocates for successful qualified plan and participant retirement outcomes through the collaborative efforts of experienced, qualified retirement plan advisors, investment firms and asset managers, and defined contribution plan service providers.

Retirement Advisor Council is a brand of EACH Enterprise, LLC

This material is intended for an audience of financial advisors and ERISA plan fiduciaries residing in the United States. It is not intended for plan participants or for the general public.

The sole purpose of this material is to inform, and it in no way is intended to be an offer or solicitation to purchase or sell any security, other investment, or service, or to attract any funds or deposits. This article does not consider the actual or desired investment objectives, goals, strategies, guidelines, or factual circumstances of any investor in any fund(s). Before making any investment, each investor should carefully consider the risks associated with any investment, and make a determination based upon their own particular circumstances, that the investment is consistent with their investment objectives and risk tolerance.

Retirement plans are complex, and the federal and state laws or regulations on which they are based vary for each type of plan and are subject to change. In addition, some products, investment vehicles, and services may not be available or appropriate in all workplace retirement plans.

Investments and concepts mentioned in this document may not be appropriate for all clients. Retirement plan sponsors and plan administrators should consult their investment, tax, and legal advisors and carefully consider all of the benefits, risks, and costs associated with a plan (a) before adopting any plan, (b) regarding any potential tax, ERISA and related consequences of any investments or other transactions made with respect to a retirement plan or account.

The Retirement Advisor Council does not sell securities, does not provide investment advice, legal advice, or tax advice. The Retirement Advisor Council is not an ERISA 3(16) plan fiduciary.