Nick Gage, CFA

Senior Principal

Galliard Capital Management

While they share a common investment objective of principal preservation, stable value and money market funds utilize fundamentally different approaches to achieve that objective, providing stable value funds a significant advantage when it comes to long-term returns. Whereas money market funds invest solely in short duration assets, stable value funds typically invest in a diversified portfolio of short- and intermediate-term fixed income securities through the use of investment contracts. As a result, stable value funds provide investors a unique opportunity – available only through tax-qualified defined contribution plans – to protect principal while also earning consistent yields and bond-like long-term returns.

Stable value investment contracts

A stable value fund’s investment contracts are designed to allow typical participant transactions to be made at the contract’s book value, regardless of the price fluctuations reflected in the market value of its underlying fixed income securities. The interest rate credited by the contracts is guaranteed by the issuer to be no less than 0%. The types of stable value contracts most commonly utilized in diversified stable value funds also allow investors to benefit from the performance of the underlying investments, smoothing their returns over time via the credited interest rate.

Low Return Volatility

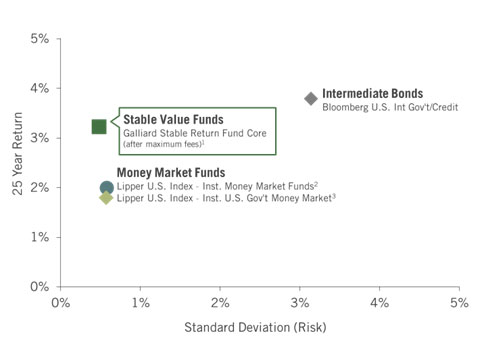

Due to their contract value accounting, stable value investment contracts allow managers to invest in short- to intermediate-term fixed income securities while insulating participants from return volatility associated with market behavior. Stable value funds have historically delivered higher long-term returns with return volatility comparable to money market funds, which typically invest in shorter duration government securities, certificates of deposit, commercial paper, or other liquid, high quality securities.

CURRENT Interest Rate Environment

In the current interest rate environment, in which short-term interest rates have risen significantly and the U.S. Treasury curve is inverted, stable value funds may be at a near-term disadvantage to money market investments with respect to yields – particularly, existing stable value funds that have provided their investors protection from recent mark-to-market losses due to rising rates. However, stable value funds’ ability to invest in longer maturity assets diversified across the investment grade sectors of the bond market provides a more robust, diversified source of yield than that of a money market fund and a critical source of additional return to meet its long-term objectives.

Long-Term Performance Advantage

With the advantage of investing in longer maturity assets, stable value funds have historically provided excess long-term annualized returns of approximately 100 to 200 basis points (1.00% to 2.00%) versus money market funds and have also provided a rate of return that has kept pace with the long-term rate of inflation. While they are not designed to hedge inflation – which reached historically high levels in the last year, stable value funds have historically demonstrated an ability to preserve savers’ purchasing power over their savings plans’ longer term investment horizons. Stable value funds have a demonstrated track record of providing attractive returns, while also providing the daily principal protection and liquidity that investors value, whether they are growing their savings or seeking a stable source of income during retirement.