It's no secret that profit margins in the defined contribution and asset management businesses are under tremendous pressure. Plan administrators have been running on fumes (i.e. microscopic margins) for years, which means they will do whatever they can to deflect the pressure elsewhere. Asset management and plan consultant services are bearing the brunt of the changes.

As part of our latest research effort, Sway Research surveyed just over 200 DC plan consultants, including those at firms that specialize in employer-benefits and those who have both a large wealth management practice and a substantial book of DC plans. We asked this group to rate their level of agreement with the following statement:

I/we have experienced substantial fee compression in the DC plans we sell and service.

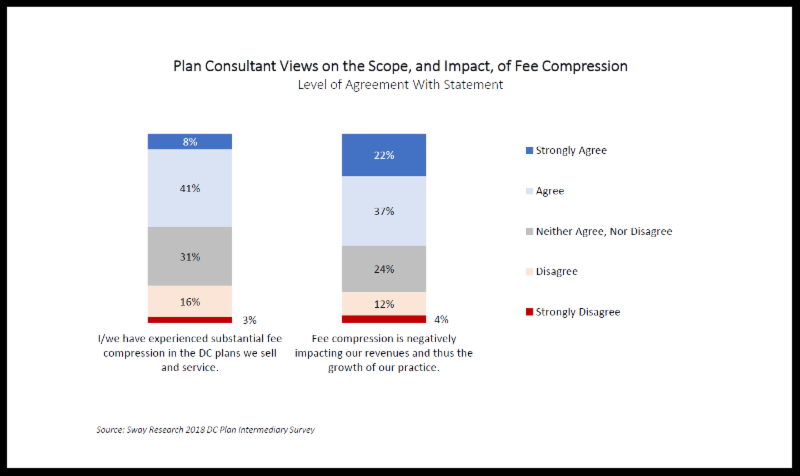

As shown in the accompanying exhibit, 49% of respondents agreed, 8% of whom did so strongly, while just 19% disagreed. So, what is the impact of fee compression to these practices? Well for one thing, an even greater percentage of respondents agreed with this next statement:

Fee compression is negatively impacting our revenues and thus the growth of our practice.

Nearly three in five respondents share experiencing revenue erosion resulting from the downward pressure on DC plan fees, which is impacting the ability to grow. Nearly a quarter are in strong agreement, suggesting this is a significant issue for these plan consultants.

What are some logical responses to this issue? Well, clearly one way to deal with this is to deflect the fee cuts towards the investment providers. Some margins left in this business are held by asset managers, particularly active managers. Thus, there's the recent rush to bring more passively investments into DC plan menus, which has also been spurred on by the litigious environments surrounding plan menus and investment selection. In fact, more than half (53%) of DC Plan consultants say they are increasing usage of passive options in plans, even though more than a third of their DC plan AUA are already held in passive products.

Another area ripe for cost cutting is in investment vehicle (i.e., shifting from higher-cost mutual funds to lower cost collectives). This year, two in five survey respondents acknowledge ramping their use of CITs in DC plans as well. The level is even higher among consultants who focus on plans in the $20M to $50M range.

But, wringing out fees from investments can only go on for so long, before there's nothing left to cut, and only a few asset managers are left standing. A world with only Vanguard and BlackRock may make for easier decision-making when it comes to populating investment menus, but plan consultants will have lost more than a much wider array of investments from which to choose. If it comes to this, plan consultants will have also lost many of their key allies in growing a DC plans business.

Each year, in addition to surveying plan consultants, Sway surveys the DCIO sales leaders of approximately 30 leading asset managers. And, each year when asked about their top-priorities for investment, these executives place the development of value-support programs and services for plan consultants near or at the top of their list. The only area ahead of this is usually staffing, which is mostly internal and external DCIO representatives who are tasked with supporting plan consultants. With asset management becoming increasingly commoditized, the value-add side of the equation, whether delivered through the market knowledge and expertise of staff, or via tools and programs designed to help plan consultant's prospect for, and close, more business, these services are a tremendous aid not only to plan intermediaries, but plan sponsors and participants as well.

Whether its tools to analyze the performance and suitability of a plan administrator or Target-Date series, staying up to speed on the regulatory front, or enhancing the understanding of plan profitability, DCIO sales and marketing units provide tremendous amount of value to plan consultants. So, keep this in mind the next time you're filling out a plan menu. Saving a few basis points by switching from active to passive management may seem like the best move in the short-run, but at what cost in the long-run? Selling and supporting plan sponsors and participants requires a great deal of investment from a wide range of parties, and when there's only a couple left standing-a couple who are essentially giving away their services to win the business-there may be no one left to help you grow yours.

Chris J. Brown,

Founder and Principal Sway Research

For more information about Sway Research, visit www.swayresearch.com