It’s Time to Act on

Retirement Income Solutions

CONTRIBUTORS

Members of the Editorial Board:

Co-chairs:

Robert A. Massa ChFC®, CEBS®, AIF®, CPFA®, CHSA®

Jeanne J. Sutton CFP®, CPFA®

Contributors:

Timothy J. Black AIF®

Nate Cassel

Shelby Columbus

Nora Connerty

Paul D’Aiutolo AIF®, CRPS®, PRP®

Chris Geddie CFP®

Amy Hindia

Amber Kendrick CPFA, CRPS®

Alicia Klingensmith CRPC®

Joe Lee

Brad J. Pinter CRPS®, AIF®, ChFC, CBFA®

Kaci Skidgel C(k)P®, QPFC, AIF®

The need for retirement income

solutions and the resistance to act

For years, the retirement plan industry has talked about the need for retirement income solutions (RIS). It is widely agreed that employees should be better prepared for their transition from saving and accumulating a retirement nest egg to creating a lifelong stream of retirement income.

The problem is that despite good intentions, defined contribution (DC) plans have failed to properly replace the retirement income security that had existed under traditional defined benefit pension plans. Since DC plans were introduced in the 1980s, extensive efforts have been made to educate plan participants. Bolstering those efforts, for the past 15 years or so, automated features – including auto-enrollment, auto-escalation, and asset allocation defaults into target-date funds – have become widely implemented. The SECURE Act 2.0 of 2022 will further advance participant retirement readiness with enhanced adoption of these features.

These efforts have made a measurable difference, boosting plan participation and savings rates, and improving retirement readiness to some degree. But a large gap remains between where pre-retirees typically are financially and where they should be. Even among those who have accumulated a sufficiently large nest egg, many have no idea how to safely and responsibly convert those assets into lifelong retirement income.

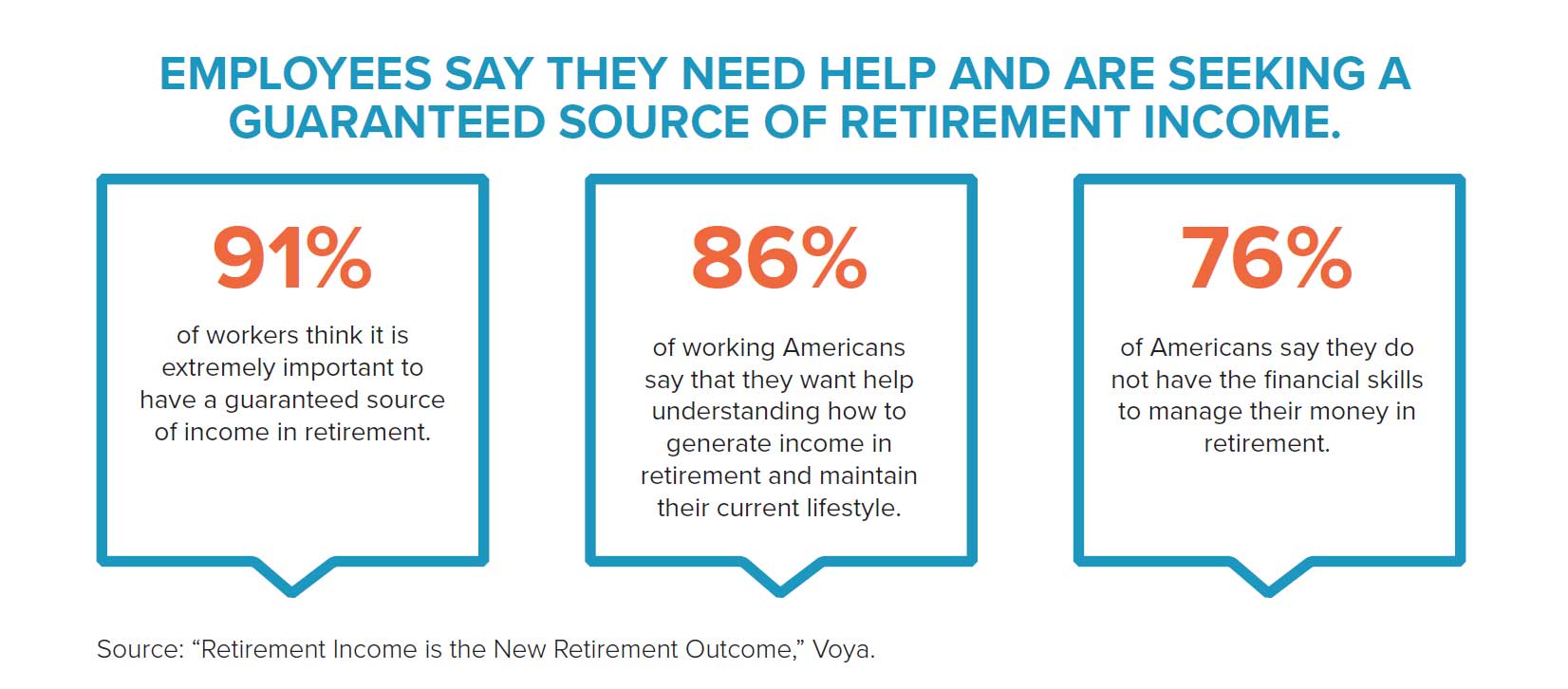

Employees say they need and want this. Studies repeatedly indicate a need and interest in retirement income solutions among employees. Nine in 10 workers say it’s important to have a guaranteed source of retirement income. More than eight in 10 say they want help in understanding how to generate retirement income so that they can maintain their lifestyle. More generally, three in four say they lack the financial skills to manage their money in retirement. (See further details and sourcing for these statistics in the next section.)

Slow implementation. Despite all of the above, however, implementation of RIS has been slow for several reasons:

-

Who’s first? Plan sponsors have been reluctant to be the first to implement an RIS although many have expressed a high level of general interest. Why the hesitancy? Factors include the novelty of going beyond the familiarity of providing a well-established employee savings vehicle. A key concern is that including a form of guaranteed lifetime income will increase exposure to fiduciary risk.

-

Fiduciary risks can come in various forms.

If retirement income solutions are more costly, can they still be justified from a fiduciary cost-management perspective? For example, how does one measure value or compare a cost-versus-benefit analysis with a cost-only analysis? What potential fiduciary risks would be involved in the unlikely event that an insurance company becomes insolvent and is unable to fulfill its obligatory lifetime payments?

Fortunately, the SECURE Act of 2019 has addressed these concerns (see section titled “MakingRetirement Plans more SECURE. ”) Ultimately, all fiduciary risks can be managed. To begin with, acting in a thorough and thoughtful manner while placing plan participant needs and concerns first is a critical way to mitigate fiduciary risk.

-

Annuities may have a questionable reputation.

Guaranteed lifetime income solutions are essentially annuities, and for years many people have had mixed feelings and negative connotations regarding annuities. These are based on perceived high fees and a reluctance to be locked into a deferred annuity with no access to the assets for years. Perceived pressure tactics from annuity salespeople have not helped. Beyond these concerns, many people are inherently reluctant to relinquish control of their life savings.

Do you need to decide between flexibility and security?

Additionally, many consumers sense they would have to decide between committing to a lifelong guaranteed income product and having the flexibility and personal control to make withdrawals as needed. Of course, one can have both. The hybrid solution, discussed in detail further on, could combine a base level of guaranteed income used to meet fixed basic costs along with a source of flexible funds that could be withdrawn as needed to pay for discretionary items. Another annuity-type option called a Guaranteed Lifetime Withdrawal Benefit does not require the irrevocable decision that come with immediate annuities and allows participants to access their money at all times.

Meanwhile, an estimated 10,000 baby boomers are retiring each day, a rate that is projected to continue through 2030. Further, recent legislative support in the form of the SECURE Act and SECURE Act 2.0 is a timely and critical development that should encourage retirement plan advisors and sponsors to embrace RIS in greater numbers. Let’s consider whether plan sponsors should provide employees with in-plan retirement income solutions; how the SECURE Act and SECURE 2.0 could make a difference; and key considerations for implementing retirement income solutions

The case for providing employees with

retirement income solutions

-

Employees want/need help. Based on survey results, most employees want or need the guidance and financial peace of mind that could come from an employer sponsored retirement income solution. They don’t have much financial knowledge or confidence and they place a substantial level of trust in their employer.

-

Cost efficient for plan sponsors. Assuming that plan sponsors select an in-plan RIS option, retaining more assets in a DC plan can help to keep plan costs low through economies of scale and the retention of the higher-balance accounts that many retirees have grown.

-

Reduced employee stress/improved productivity. Employees who have greater financial confidence and less financial stress tend to be more able to focus on their jobs as they typically are happier and less distracted. Over the long term, they would also tend to be less likely to delay their retirement for financial reasons. Consider the loss of overall productivity if a business were to rely on employees who don’t want to be there but feel they have to be beyond their

normal or preferred retirement age. Overall, it’s easy to make the case that an organization with more financially secure employees will also have more productive employees.

-

Competitive edge for employers. An in-plan RIS can be a major advantage in attracting and retaining employees, a particularly important consideration at this critical time, with a widescale shortage of labor in the past few years. According to Invesco’s 2022 “Show Me the Income” research study, practically all participants (97%) would view their employer favorably if they added an RIS.

Retirees who keep their assets in a DC plan generally benefit from lower costs and access to some products that they wouldn’t have access to in a regular IRA. Consider how much more attractive a prospective employer could be to many potential employees simply by addressing this concern and how much easier it could be to retain experienced, productive, loyal employees who feel their company values them and will help to provide for their lifelong financial security.

-

The need is greater than ever. It could be considered a perfect storm: The recent impact of COVID-19, the “great resignation,” the 2022 stock market downturn, skyrocketing inflation, and ongoing economic uncertainty all make it even more vital for pre-retirees and current retirees to be able to receive financial guidance. This is on top of the basic challenge of knowing how to convert assets to reliable lifetime income.

-

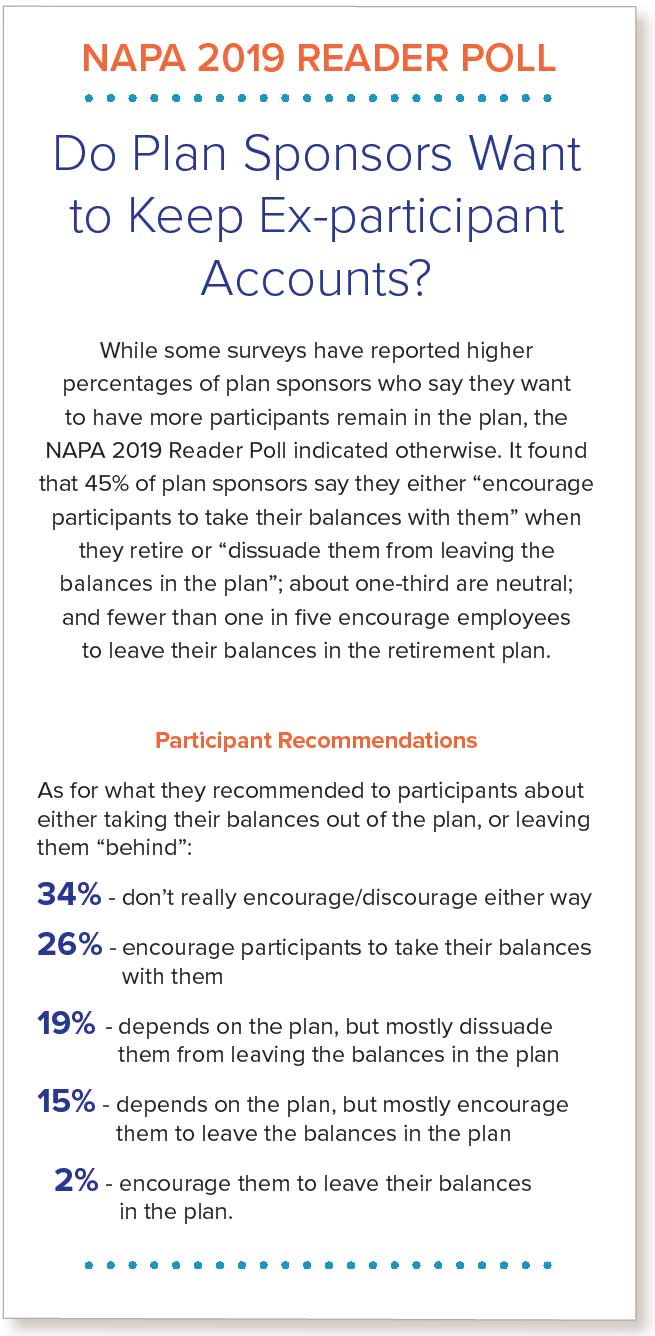

A commonly missed opportunity. There is a flashing sign of a missed opportunity if we look at both the low percentage of plan sponsors who encourage employees to leave their balances in the plan (see the results of the NAPA 2019 Reader Poll in the sidebar) and the high percentage (28%) of pre-retirees who say they don’t know if they are allowed to stay in the plan after retirement. Contrast those statistics with the strong case presented here for providing retirement income solutions within the DC plan.

Why are so many employers not doing more to encourage retirees to remain in the plan? Wouldn’t creating and promoting a robust retirement income solutions component within your DC plan go a long way to resolving this?

A recent catalyst to help establish greater comfort among plan sponsors in adding RIS to their DC plans is the SECURE (Setting Every Community Up for Retirement Enhancement) Act, passed by the U.S. Congress in 2019. This landmark legislation includes several elements targeted to facilitate easier and more widespread usage of retirement income solutions. Key here is the removal of much of the perceived fiduciary risk.

-

Provides fiduciary safe harbor. The SECURE Act reduces fiduciary risk through a safe harbor that protects sponsors in the event that an insurer who issues a guaranteed income product becomes insolvent and is unable to make the promised payments to annuitants. In that rare event, a sponsor would not be liable as long as it engages in an objective, thorough, and analytical search, and considers the cost of the contracts versus their benefits.

Importantly, the SECURE Act makes clear that the costs on an annuity needn’t be the lowest as long as the sponsor considers the costs in relation to its benefits and concludes that they are reasonable.

-

Lifetime income estimate disclosure – The SECURE Act requires plan sponsors to provide annual lifetime income estimates to plan participants. By providing a ballpark estimate of what one’s account balance might convert to in terms of a regular source of lifetime-guaranteed income, employees are not just given relevant, helpful information. They are also being prompted to think more in terms of retirement income security and less about an arbitrary goal of assets to aim for in their respective retirement accounts.

This emphasizes the importance of lifetime income and can provide a valuable reality check for employees. How secure would their financial situation be at a certain level of total retirement savings? How much more do they need to save? And what would that convert to in terms of a retirement budget and lifestyle?

-

Portable lifetime income options – By making lifetime income fully portable, this enhances the value of a DC plan’s RIS. It also will lead to improved retirement outcomes for employees.

Having presented a number of points that delineate the need for assisting employees in their transition from saving and accumulating assets to the drawing down or decumulation period, let’s explore how best to do it.

IN-PLAN VERSUS OUT-OF-PLAN RETIREMENT INCOME SOLUTIONS.

We have already presented the case for keeping participant assets within the plan, so it needn’t be elaborated on here. However, this is a brief acknowledgement that a plan sponsor could see the merit of encouraging employees to explore retirement income solutions outside of the DC retirement plan. However, for the reasons already cited, including cost efficiencies that the employer and employee could benefit from, and the advantage of attracting and retaining more-productive employees, we strongly believe in the merit of incorporating RIS within the DC plan.

GUARANTEED AND NON-GUARANTEED IN-PLAN INCOME SOLUTIONS.

While guaranteed lifetime income solutions can provide the peace of mind of ensuring individuals will always have a source of reliable income, they don’t address the need for other more flexible sources of income.

Non-guaranteed income could be withdrawn from a variety of possible assets in the event of a discretionary expense, such as a vacation, or an unplanned emergency expense (for example, a sudden home repair or sizeable medical bill). The possible sources of this type of income could include the entire spectrum of investments and savings vehicles – from the safety and security of a bank account, certificate of deposit, or short-term government bond to the higher growth

potential of stocks/stock funds, more volatile but higher-earning bonds, real estate, and commodities.

Without getting into the minutiae on the importance of having a sufficient source of emergency funds or the need for some element of potentially higher capital growth even among retirees, the point here is the potential benefit of a hybrid solution. A retiree should have a source of guaranteed lifetime income while also maintaining access to assets that can be drawn from on a flexible, as-needed basis. The use of an account that provides a guaranteed source of lifetime income needn’t imply an all-or-nothing decision. By combining reliability and flexibility, retirees can have the best of both worlds and meet a spectrum of financial needs.

OFFER A VARIETY OF RETIREMENT INCOME OPTIONS.

Accordingly, a set of retirement income options should offer a variety of choices. In addition to a guaranteed lifetime income product, these could include:

-

Systematic withdrawals – automated steady withdrawals that provide a simple source of regular

income but are not guaranteed for life -

Managed payout funds – somewhat similar to systematic withdrawals, these generate steady monthly income that is reliable but is not a lifetime-guaranteed solution

-

Intelligent withdrawal solutions – these could provide regular tax-efficient income from multiple accounts while meeting individual needs and preferences

-

QDIAs that reflect and support the transition to retirement (details in the next section)

-

Partial distributions – these offer an alternative to an all-or-nothing approach to account withdrawals.

About The Council

About The Council