Retirement Advisor Council Blog

Why plan sponsors are taking a fresh look at hybrid defined benefit plan designs[1]

By Milliman consultants Sarah Murray, FSA, EA, MAAA, Principal & Consulting Actuary, and Mary Markham, Director of DB Client Relations

Two types of hybrid defined benefit plan designs have been in the spotlight recently: cash balance pension plans and Variable Annuity Pension Plans (VAPPs). Neither plan design is new, but legislation in recent years has made them more viable options for employers. In this article we explore these two options for plan sponsors contemplating a potential change in retirement plan design.

Two types of hybrid defined benefit plan designs have been in the spotlight recently: cash balance pension plans and Variable Annuity Pension Plans (VAPPs). Neither plan design is new, but legislation in recent years has made them more viable options for employers. In this article we explore these two options for plan sponsors contemplating a potential change in retirement plan design.

What are cash balance pension plans?

Cash balance plans have been around since the 1980s, and they are a popular option for small business owners. In the large plan space, IBM made headlines in late 2023 with the announcement that it was reopening its frozen traditional pension plan and replacing its previous 401(k) retirement benefit with a cash balance benefit in the reopened plan. IBM’s decision has prompted a lot of discussion in the retirement industry about the possibility of other corporate plan sponsors reopening their own frozen pension plans.

A cash balance plan is a defined benefit (DB) plan that has several characteristics of a defined contribution (DC) plan. It’s often referred to as a hybrid plan, blending the traits of both DB and DC plans. Cash balance benefits are earned in the form of a pay credit and an interest credit. The pay credit can be a dollar amount per year or a percentage of the participant’s annual salary. The interest credit can be a fixed rate or a variable rate linked to an index. The specific details of a plan’s interest credit and pay credit are laid out in the plan document and must meet various legal requirements, such as not discriminating in favor of highly compensated employees.

The funding or assets for the cash balance plan are held in a pooled account. Each participant’s benefit is communicated in terms of a hypothetical account balance that grows with the pay credits and interest credits.

Why a plan sponsor might consider a cash balance plan

A cash balance plan design can be easier to understand than other pension plans, a feature that benefits both the plan sponsor and its employees. A cash balance plan can look and feel like a 401(k) plan design, which is already familiar to a lot of people. The simplicity in design makes

communicating the value of the benefit easy to understand and easy for participants to track the cash balance account growth.

Cash balance plans can serve as a strategic instrument for employee retention. Employers can leverage comprehensive retirement benefits, including cash balance plans, to not only attract but also retain seasoned talent within their workforce. By providing an appealing avenue for retirement savings, these plans encourage prolonged tenure among employees. With cash balance accruals credited annually, employees find motivation in witnessing the growth of their accounts, fostering a commitment to their current employment.

Employers may be able to achieve certain objectives and administrative advantages with the cash balance design. Take pay credits as an example. A flat pay credit (either flat dollar amount or flat percentage of pay) can be used for simplicity in communication and to make satisfying nondiscrimination testing requirements easier. Tiered pay credits can be used to give greater contributions to certain participants, such as those who have more service with the company. Benefit formulas must meet regulatory requirements like the aforementioned nondiscrimination testing, but there are options to suit a variety of employer goals.

Administratively, there tends to be fewer manual calculations due to the straightforward nature of the plan, which can also reduce the burden of monthly maintenance tasks. The features of these plans increase efficiency of plan administration, ensuring accurate and timely processing of participant transactions. Additionally, the simplicity of cash balance plans makes them more conducive to administering qualified domestic relations orders (QDROs), further simplifying the process for participants and plan administrators alike.

The contribution limits for a cash balance plan are higher than those for a 401(k) plan, so greater tax-deferred contributions can be made. If an employer offers both a cash balance plan and a 401(k) plan, the contribution limits are separate for the two plans, resulting in even greater tax deferral.

There are also options for the employer in terms of who bears the investment risk in a cash balance plan. If the interest crediting rate is set up as a fixed rate, the participant is protected from investment risk because their account is guaranteed to grow at the fixed rate each year. An alternative is a market-based cash balance plan where the interest crediting rate is linked to the plan’s asset return; in this case, much of the investment risk is transferred to the participant.

Plan assets are combined and professionally managed, so the participant isn’t responsible for making investment choices. Whether this is an advantage depends on who you ask. Some participants may see this as a negative if they prefer to manage their own investments and believe they could achieve higher investment returns in a 401(k) plan. Other participants may appreciate a guaranteed return (if the interest crediting rate is fixed) and not having to make investment decisions themselves.

Cash balance benefits are typically covered by the Pension Benefit Guaranty Corporation (PBGC), unlike 401(k) plans. This federal insurance protects participants’ benefits up to certain limits. Note that annual premiums must be paid by plans that are covered by the PBGC insurance.

Plan sponsors should also be aware that cash balance plans are subject to annual minimum funding requirements that are calculated under IRS rules, so employers don’t always get to choose how much to contribute to the plan in any given year.

How do participants benefit from cash balance plans?

Cash balance plans offer several benefits to participants, making them an attractive option for retirement planning. One of the key advantages is the transparency they provide. Unlike traditional defined benefit plans, where benefits are calculated based on complex formulas tied to years of service and salary history, cash balance plans offer individual account balances. This allows participants to easily track the growth of the balance over time and understand the factors influencing their benefits. This is something most participants can easily translate in their minds due to the similarities to DC plans.

Furthermore, cash balance plans typically provide detailed statements that break down contributions, interest credits, and account balances. This makes it easier for participants to understand how their savings are accumulating, providing a clear picture of their retirement income. This increased transparency can enhance financial literacy and empower employees to make more informed decisions about their retirement savings.

Cash balance plans offer flexibility in payment options to participants, accommodating diverse preferences and enhancing participants' ability to tailor their retirement benefits to best suit their individual needs and circumstances, ultimately promoting financial well-being in retirement. Plans are required to offer the option of receiving lifetime income through an annuity and typically allow participants to opt for a lump sum payout instead. This combination of mandatory and optional payment methods empowers participants to make decisions based on their unique circumstances and financial goals. For some, the stability and longevity of annuity payments may be preferable, offering a steady income stream throughout retirement. Others may prefer the liquidity and immediate access to funds provided by a lump sum payout, enabling them to pursue specific financial objectives or investments. An advantage to the lump sum option at termination of employment is the portability of the benefit. If the participant terminates prior to retirement, they can roll over the lump sum to an account of their choosing.

Although they are similar, perhaps the biggest difference between a cash balance plan and a 401(k) plan is a benefit to the participant; a cash balance plan typically doesn’t require employees to contribute part of their salary to participate. Participants must be vested in their cash balance benefits no later than after three years of service, which is a faster vesting schedule than the requirements for traditional DB plans.

What are Variable Annuity Pension Plans?

VAPPs have been around since the 1950s but interest has increased in recent years due to additional regulatory guidance.

In a basic VAPP, the participant earns benefits for each year of service with the employer. The benefit formula is typically a flat dollar or career average accrual. The benefits earned can move up or down each year based on the plan’s actual asset return, even after retirement. A target return rate is established in the plan and, if the actual return equals the target, then benefits do not change. Benefits increase if the actual asset return is greater than the target rate. Inversely, benefits decrease if the actual asset return is less than the target rate. The result is that plan assets and liabilities move up and down together and thus the plan stays fully funded regardless of current market conditions.

A disadvantage to the basic VAPP is that benefits decrease in years where asset return is less than the target. The Milliman Sustainable Income Plan (SIP) is a variation on the VAPP design that tackles this benefit volatility. In addition to having the regular VAPP features, including contribution and funded status stability, the SIP also includes downside protection for participants in retirement. The SIP does this by using a stabilization reserve that builds up excess assets in years of good asset return, to help cover participants’ benefits in future years when returns are less than the target. Thus, the SIP significantly reduces the chance that benefits would decline in down markets.

Why a plan sponsor might choose a VAPP

One of the most attractive features of a VAPP is that it stays fully funded in all market conditions. This removes the balance sheet volatility that is associated with many traditional DB plans. The contributions are more stable and predictable as the employer funds the benefits earned plus plan expenses. This eliminates the need for additional employer contribution amounts to make up for a funding shortfall.

Participants have PBGC protection for their benefits and the plan pays lower PBGC premiums due to being fully funded. One part of the PBGC insurance premium is a flat rate, based on participant head count, while another part is a variable rate based on the underfunded amount of the plan’s liabilities compared to its assets. A fully funded plan does not have to pay the variable rate portion.

To help meet their objectives, plan sponsors have design options when setting up a VAPP, such as using the stabilization reserve mentioned above to protect participants’ benefits from decreasing in retirement. A VAPP can have a floor and/or ceiling on the amount of asset return to consider when adjusting benefits, to provide more benefit stability.

Plan sponsors who implement a VAPP should note that participants may need initial education about the plan, as well as ongoing communication about benefit adjustments. A robust communication campaign in the beginning stages can help facilitate a successful transition to a VAPP.

How do participants benefit from a VAPP?

VAPPs offer several benefits to participants. Like plan sponsors, participants benefit from a VAPP’s feature of staying fully funded in all market conditions. This design provides participants with a reliable source of retirement income and removes the uncertainty that can be associated with other types of retirement plans. By sharing in the investment returns, it is more likely that the benefit will be available for the lifetime of the participants.

VAPPs also provide a lifetime benefit for participants in retirement and can include inflation protection. This ensures that participants' benefits will keep pace with the cost of living, providing them with a stable and secure income throughout their retirement based on actual economic conditions. Benefits can increase even in retirement. In addition, participants in VAPPs benefit from the professional management of investments in the plan. They don’t have to make individual investment decisions themselves, which can be a relief for those who prefer not to navigate the complexities of investment management.

Participant benefits have layers of protection. They are protected by the PBGC, and VAPPs with a stabilization reserve (as described above) offer protection against participants’ benefits decreasing in retirement, providing additional security.

Participants may find it easier to relate to VAPPs due to their familiarity with volatility in the market. The alignment of VAPPs with market dynamics can resonate with participants, as they may already be accustomed to navigating fluctuations in their personal investment portfolios or witnessing the impacts of market volatility on broader financial landscapes. By mirroring the ups and downs of the market, VAPPs provide participants with a tangible connection to the performance of their retirement savings, fostering a sense of engagement and understanding. Communicating the relationship between VAPPs and market volatility to plan participants is crucial. Fostering transparency and trust between plan sponsors and participants ensures that participants are fully aware of how their retirement benefits are structured and the factors that may influence their future payouts.

Which pension plan design to choose?

Both cash balance plans and VAPPs offer unique benefits to participants, making them attractive options for retirement planning.

When contemplating a new plan design, plan sponsors should first focus on the objectives they are trying to achieve as an organization. Particular goals may include increasing retirement income security for participants, reducing balance sheet volatility, attracting and retaining employees, or achieving more stable contribution patterns, just to name a few. Cash balance plans and VAPPs have both advantages and disadvantages, like any retirement plan, but one of these plans could be the design that fits the needs and goals of your company. The choice between the two will depend on individual circumstances, preferences, and the specific features of the plans you offer.

For more information on cash balance pension plans or Variable Annuity Pension Plans (VAPPs), or for assistance with finding the right retirement plan design for your organization, please contact your Milliman consultant.

[1] This article is an update of the May 2024 Milliman article, Two designs worth a look for corporate plan sponsors: Cash balance pension plans and Variable Annuity Pension Plans, available at https://www.milliman.com/en/insight/two-designs-corporate-plan-sponsors-cash-balance-variable-annuity-pension.

Advisor Q&A: Courtenay Shipley Brings Creative Fuel to the Retirement Industry

Retirement Advisor Council Board President Courtenay Shipley, Founder and “Chief Planologist” at Retirement Planology, talks about her unique perspective and what fuels her passion for the industry

Benjamin Franklin once said, "If you want something done, ask a busy person to do it.” That explains a lot about  Courtenay Shipley, Founder and Chief Planologist at Retirement Planology, a consulting and investment advisory firm dedicated to helping organizations make smart decisions about their employee retirement plans. She juggles that role, family responsibilities, and many others every day. Moreover, her commitment to the retirement industry and helping Americans retire with dignity and financial surety never waivers.

Courtenay Shipley, Founder and Chief Planologist at Retirement Planology, a consulting and investment advisory firm dedicated to helping organizations make smart decisions about their employee retirement plans. She juggles that role, family responsibilities, and many others every day. Moreover, her commitment to the retirement industry and helping Americans retire with dignity and financial surety never waivers.

Currently, Shipley serves as the Board President of the Retirement Advisor Council (RAC). The Council advocates for successful qualified plan and participant retirement outcomes through the collaborative efforts of experienced, qualified retirement plan advisors, investment firms, asset managers, and defined contribution plan service providers. As her tenure as RAC Board President draws to a close, we took the opportunity to ask her a few questions about the Council, the industry, and what she sees for the future of both.

Q: You have been active in the retirement industry for some time. You’ve been recognized by Financial Times Top 401 Retirement Plan Advisors annual list, named a Top Women Advisor All-Star by the National Association of Plan Advisors, and named a 2018 NAPA Young Gun: Top 75 under 40. What fuels your passion for this industry?

A: From the moment I stepped into this industry over 20 years ago, I found it was a perfect place for my skills and expertise, and I believed I could make a difference. I founded Retirement Planology with a focus on the 'smid' market—small and medium-sized businesses, with our sweet spot being those with 500 employees or less. Our client base is diverse, spanning across industries, non-profits, for-profits—the whole spectrum. Our clients are growing companies dedicated to making thoughtful business decisions, especially about their retirement plan. Working with this size of organization allows us to foster a more holistic relationship with leadership for value creation, and with the employees.

Q: What are your clients asking for and are those questions leading indicators for the industry itself?

A: We've been having refreshing discussions about retirement plans and financial education lately. We are moving past the so-called 'latte effect'—the idea that giving up a $4 latte could magically fund your retirement plan. Hint: no one wants to give up anything to save in their plan! But the combination of the Pandemic and inflation has flipped the focus on life and money. It’s about empowering folks to think about what truly matters to them, choosing where to spend their money, while ruthlessly cutting back on things that don’t matter as much. If that latte is your daily joy, that's fantastic! Let's work to ensure you'll have the funds to savor it in retirement, too. It's all part of a fresh perspective on retirement plans, woven into the fabric of a broader financial conversation.

The retirement plan is one piece of a puzzle—the comprehensive benefits program. Let’s talk data because that’s what everything leads back to now! Enter the HRIS systems, the unsung heroes in the world of compiling and managing that data--the central hub for performance management, providing valuable feedback to management while tracking trends and spotting opportunities. In this hiring environment, everyone wants engaged and motivated employees, boosted retention rates, and constrained budgets well spent. Cutting edge retirement advisors leverage that data to help with plan design, communication, education, and reporting. Plan Sponsors want effective benefits and now seek an elevated level of support from their trusted consultants and advisors to serve the big picture.

Q: Your perspective is unique. What fuels that?

A: My background is different than most advisors; in college, I majored in music performance. This education and experience have uniquely equipped me and our team to understand the intricate interplay of content, context, and composition. That symphony also applies to how I see our industry. I am analytical. I see the details. But, true to my training and education, I see the big picture as well. Creative thinking fuels creative plan design which fuels business value. Whether it's crafting strategic approaches to total compensation packages, employee retention programs, or optimizing retirement plans and HSAs, each of these components forms a crucial piece of the larger, harmonious whole.

Q: You’re very involved in the Retirement Industry more widely as well. What drew you to the Retirement Advisor Council in particular?

A: While our industry is full of associations, events, and organizations, each carrying its own significance, The Retirement Advisor Council stands out as unique. It distinguishes itself through a genuine spirit of collaboration and ongoing conversation within its membership. Notably, the Council operates with a distinctive approach: the membership actively shapes and molds the in-person meetings and virtual sessions. There is no predefined agenda. The content of every meeting and event is set by the membership.

Q: How specifically does the membership of the Council as you said, “shape and mold” the direction and content of RAC events and activities?

A: The Retirement Advisor Council serves as a hub for industry conversations—discussions that delve into the future direction of our field, the current pulse of the marketplace, emerging trends, and the challenges that professionals are encountering. Our focus is on Retirement Plan Advisors deeply committed to their clients, their clients' businesses, plan participants, and the refinement of their practices. Membership to the Council is by invitation only, and my mission has been to amplify those voices—the thought leaders, thought-sharers, and influencers—bringing them to the table with our partner service providers in the business to make a difference.

We maintain a year-round connection, extending beyond our two semiannual in-person meetings, fostering a vibrant and engaged community. My efforts have been centered on reinvigorating the mechanisms that facilitate our collective work. At the heart of this is a call for all members to actively participate in committees; each with specific and diverse goals. From meeting planning, agendas, and government affairs to research, strategic initiatives, marketing and PR, advisor tools, and financial literacy -- committees form the backbone of our collaborative efforts and thought leadership.

Q: Financial Literacy. That is certainly a hot button these days. What does the Retirement Advisor Council Financial Literacy committee do?

A: In 2022 we surveyed the Council and found that by a large margin, financial literacy was critically important to RAC members. We also discovered two things: Financial Wellness Programs are not the endgame – financial literacy really starts young and in schools. And second, grassroots efforts on the local level are clearly the most impactful.

Recognizing the pervasive impact of financial literacy, RAC launched FinLitFuture$ (FinLitFutures.com). We shifted our focus from giant, national programs to making a local difference. FinLitFuture$ is a collaborative endeavor organized by the Council, rallying the collective volunteer and advocacy efforts of members of the retirement industry. Our shared commitment revolves around advancing financial education in schools and community programs. We’re proud of this initiative. We look forward to seeing the results for 2023/24 and set the goals for the next stage. All the credit goes to our incredible Financial Wellness and Education Committee – they did an awesome job!

Q: What is next for you on the Council in 2024?

A: I plan to continue to support the Council and of course, incoming president Alex Assaley. I’m sure the transition will be seamless!

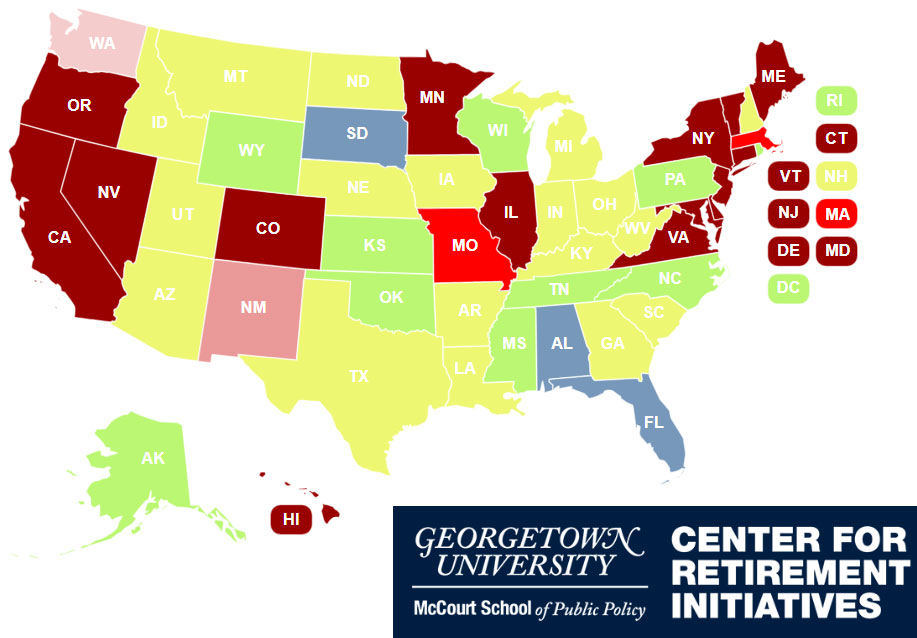

Interactive map from the Center for Retirement Initiatives at Georgetown University’s McCourt School of Public Policy keeps plan sponsors and their advisors abreast of state-by-state retirement innovation (click on map to visit interactive map website).

47 states have taken steps since 2012 to bridge the retirement plan coverage gap among small and micro employers. Some have already implemented a mandate, others are in the throes of considering legislation. Enhancing coverage is a worthwhile social goal, and an objective that the Council supports. Retirement plan sponsors and their advisors will find a wealth of resources and an interactive state-by-state map to track progress and the specifics of already-enacted state programs HERE on the website of The Center for Retirement Initiatives at Georgetown University’s McCourt School of Public Policy.

You can also follow the work of the Center for Retirement Initiatives on LinkedIn

Franklin Templeton’s Voice of the American Worker study, now in its third year, uncovered some interesting new trends and also a reversal in others that had taken root during the COVID-19 lockdown period. One thing that’s clear is workers today are feeling more financial stress and concern, which also has implications for employers.

The Voice of the American Worker annual survey, conducted by The Harris Poll on behalf of Franklin Templeton, is connected to Franklin Templeton’s Retirement Innovation Initiative (RII), which launched in January 2020. RII’s mission is to bring together industry experts who share the same vision—improving the future of retirement in the United States. The survey respondents represent a snapshot of the US workforce: across the country, across industry, and across generations and backgrounds.

The Voice of the American Worker annual survey, conducted by The Harris Poll on behalf of Franklin Templeton, is connected to Franklin Templeton’s Retirement Innovation Initiative (RII), which launched in January 2020. RII’s mission is to bring together industry experts who share the same vision—improving the future of retirement in the United States. The survey respondents represent a snapshot of the US workforce: across the country, across industry, and across generations and backgrounds.

Throughout the last three years, some evergreen trends have been reconfirmed year over year:

- Workers continue to seek improved well-being and need support in addressing existing roadblocks.

- A focus on well-being continues to include urgency in improving financial health with key opportunities for employer support.

- Workers remain more focused on financial independence than traditional retirement.

- There has never been a more urgent time for employers to evaluate their benefit offerings and consider ways to evolve how employee needs are supported.

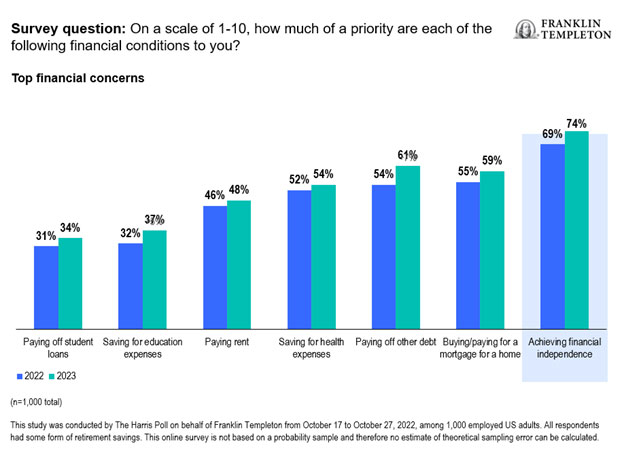

Financial independence remains a top priority.

If financial independence is defined as “having enough income or wealth sufficient to pay one’s living expenses without having to be employed or dependent on others”, the path to achieving financial independence will not look the same for everyone.

Survey finding: All in all, regardless of the current economic or workforce environment, employees continue to view financial independence as their primary north star. This year, 74% stated financial independence is their top financial concern, up from 69% in last year’s study. In addition, 81% of respondents said they are more focused on becoming financially independent. Among other concerns, the next most important was paying off debt (61%), which was up 7% since last year. That is not surprising given that US credit card debt levels just hit a 20-year high.

Action item for employers: We as an industry and employers have a key opportunity to engage employees across the full spectrum of financial aspects and provide holistic support in helping employees reach financial independence. Three-quarters (77%) of survey respondents said they’d be more likely to participate or contribute more to their retirement savings if there were more personalized 401(k) investment options, and they are seeking access to advice. They want access to a financial advisor, they want auto-enrollment, tax guidance, budgeting and debt guidance.

The Voice of the American Worker study was conducted by The Harris Poll on behalf of Franklin Templeton from October 17 to October 27, 2022, among 1,000 employed U.S. adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed U.S. adults, and findings from 2021 reference a similar survey conducted among 1,005 employed adults from October 28 to November 15, 2021.Franklin Templeton is not affiliated with The Harris Poll, Harris Insights & Analytics, a Stagwell LLC Company.

For additional information, please contact the Franklin Templeton Workplace Retirement team at (800) 342-5236, or visit https://www.franklintempleton.com/insights/research-findings/voice-of-the-american-worker-survey.

IMPORANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the author and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this presentation has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Franklin Distributors, LLC. Member FINRA/SIPC. Prior to July 7, 2021, Franklin Templeton Distributors, Inc., and Legg Mason Investor Services, LLC served as mutual fund distributors for Franklin Templeton.

Nick Gage, CFA

Senior Principal

Galliard Capital Management

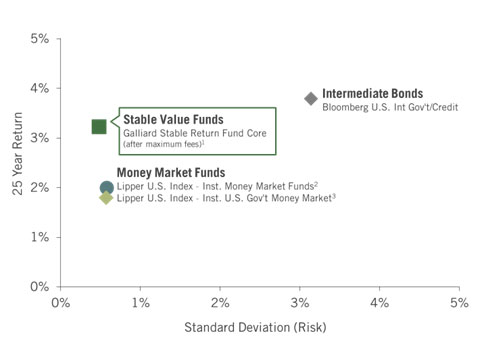

While they share a common investment objective of principal preservation, stable value and money market funds utilize fundamentally different approaches to achieve that objective, providing stable value funds a significant advantage when it comes to long-term returns. Whereas money market funds invest solely in short duration assets, stable value funds typically invest in a diversified portfolio of short- and intermediate-term fixed income securities through the use of investment contracts. As a result, stable value funds provide investors a unique opportunity – available only through tax-qualified defined contribution plans – to protect principal while also earning consistent yields and bond-like long-term returns.

Stable value investment contracts

A stable value fund’s investment contracts are designed to allow typical participant transactions to be made at the contract’s book value, regardless of the price fluctuations reflected in the market value of its underlying fixed income securities. The interest rate credited by the contracts is guaranteed by the issuer to be no less than 0%. The types of stable value contracts most commonly utilized in diversified stable value funds also allow investors to benefit from the performance of the underlying investments, smoothing their returns over time via the credited interest rate.

Low Return Volatility

Due to their contract value accounting, stable value investment contracts allow managers to invest in short- to intermediate-term fixed income securities while insulating participants from return volatility associated with market behavior. Stable value funds have historically delivered higher long-term returns with return volatility comparable to money market funds, which typically invest in shorter duration government securities, certificates of deposit, commercial paper, or other liquid, high quality securities.

CURRENT Interest Rate Environment

In the current interest rate environment, in which short-term interest rates have risen significantly and the U.S. Treasury curve is inverted, stable value funds may be at a near-term disadvantage to money market investments with respect to yields – particularly, existing stable value funds that have provided their investors protection from recent mark-to-market losses due to rising rates. However, stable value funds’ ability to invest in longer maturity assets diversified across the investment grade sectors of the bond market provides a more robust, diversified source of yield than that of a money market fund and a critical source of additional return to meet its long-term objectives.

Long-Term Performance Advantage

With the advantage of investing in longer maturity assets, stable value funds have historically provided excess long-term annualized returns of approximately 100 to 200 basis points (1.00% to 2.00%) versus money market funds and have also provided a rate of return that has kept pace with the long-term rate of inflation. While they are not designed to hedge inflation – which reached historically high levels in the last year, stable value funds have historically demonstrated an ability to preserve savers’ purchasing power over their savings plans’ longer term investment horizons. Stable value funds have a demonstrated track record of providing attractive returns, while also providing the daily principal protection and liquidity that investors value, whether they are growing their savings or seeking a stable source of income during retirement.

By Zorast Wadia CFA, FSA, EA, MAAA CFA, FSA, EA, MAAA - Principal, Consulting Actuary at Milliman

By Zorast Wadia CFA, FSA, EA, MAAA CFA, FSA, EA, MAAA - Principal, Consulting Actuary at Milliman

Nine considerations for corporate plan sponsors after the passage of the American Rescue Plan Act of 2021

Interested to add value to your clients helping them with their DB plan? Register HERE for Growing Your Business With Pension Plans June 30, 2021 at 3 p.m. Eastern.

The COVID-19 pandemic has caused tremendous hardships for people and businesses alike. Plan sponsors of defined benefit (DB) pension plans certainly were not spared from the business and financial impacts of COVID-19. They simultaneously had to deal with burgeoning cash contribution requirements as interest rate relief provisions were scheduled to wear away starting in 2021. With financial markets declining rapidly in the first quarter of 2020 and many businesses ceasing normal operations, it appeared that plan sponsors were headed toward the eye of the perfect storm.

Fast forward to nearly 12 months later: with the passage of the American Rescue Plan Act of 2021 (ARPA) on March 11, 2021, plan sponsors were extended a new lifeline. The rules of pension funding for single employer pension plans as we had all become accustomed to for nearly the last decade and a half have undergone a complete overhaul. Just as the U.S. economy hit the financial reset button and came out of 2020 with a record recovery, corporate pension plan sponsors now get to revitalize their pension funding—the key difference being that the corporate defined benefit plan funding resurrection is expected to last through the rest of this decade!

It is important to appreciate how ARPA brings about landmark changes to pension funding for corporate plan sponsors. Much flexibility in the application of ARPA is available to plan sponsors, and the impacts of the funding relief and timing of the start of the relief should be examined. What is also of significance are the peripheral effects of ARPA on pension plan accounting, Pension Benefit Guaranty Corporation (PBGC) insurance premiums, asset allocation, and pension risk management strategies. This article summarizes nine considerations for corporate plan sponsors in light of the passage of ARPA.

ERISA funding and plan sponsor elections

To understand the impact on ERISA funding, we need to first examine how the rules changed. The two main funding relief components of ARPA were an extension of interest rate smoothing and a restart and extension of funding shortfall amortization bases. This is further summarized below.

Interest rate smoothing

ARPA provides for the use of higher segment interest rates used to calculate pension liabilities for minimum funding purposes and benefit restrictions. It preserves the stabilization effects of interest rate smoothing as follows:

- The 10% interest rate corridor surrounding the use of the 25-year average segments rates under prior law is reduced to 5%, effective in 2020.

- A 5% floor would be placed on each of the 25-year segment interest rate averages.

- The phase-out of the 5% interest rate corridor is delayed until 2026, at which point the corridor would increase by five percentage points each year until it attains 30% in 2030, where it would stay.

Extension of funding shortfall amortization bases

ARPA will lower plan sponsor costs as follows:

- All current shortfall amortization bases for prior plan years (and all shortfall amortization installments determined with respect to such bases) shall be reduced to zero (“fresh start”).

- All new shortfalls would be amortized over 15 years, rather than seven years under the prior law.

For starters, it is worth noting that the interest rate smoothing provisions under ARPA are more expansive than the previous interest rate smoothing provisions allowed under the Moving Ahead for Progress in the 21st Century Act passed in 2012 due to the compression of the interest rate corridor. Also, the interest rate floor in particular is meant to ensure stability and predictability on a longer-term basis, so that interest rate variations do not create excessive volatility. The higher interest rates under ARPA will lower the resulting plan liability and normal cost used in minimum funding requirement calculations. Moreover, with respect to the funding relief related to amortization bases, not only did ARPA more than double the amount of time that plan sponsors have to fund their shortfalls (the excess of accumulated liabilities over plan assets), but they now get to restart their efforts. All prior amortization bases that were established on a seven-year amortization schedule are eradicated under ARPA.

Besides the intrinsic relief attributes of ARPA, there are more plan sponsor privileges in terms of an inception date. Plan sponsors get the opportunity to retroactively apply the relief provisions of ARPA dating back as far as the 2019 plan year; one year earlier than the onset of the COVID-19 pandemic! Employers may have reasons to first apply ARPA at a later point in time than 2019 such as for the 2020, 2021, or 2022 plan year. Pros and cons of these options will have to be laid out alongside multiyear cost projections in many cases. The final plan sponsor elections will likely be based on consultation and guidance from various sources including plan actuaries.

The combined effect of interest rate and amortization shortfall relief is expected to be profound for many plan sponsors, especially those with plans facing current funding shortfalls. The retroactive start applications of ARPA will allow plan sponsors to “go back in time” and revise historical 2019 and/or 2020 actuarial valuations. A plan sponsor may choose this approach in order to lower its prior minimum required contributions. The reduction in minimum required contributions may be recaptured by the plan sponsor through the creation of prefunding balances. These prefunding balances can be accumulated to the present 2021 year, reflecting the favorable investment performance of 2020, and then be used to further reduce required cash contributions in 2021 and future years.

Besides the potential for immediate cash relief, many plan sponsors will find that their contribution projections are significantly lower during the next several years relative to what they were under prior law. The minimum contribution reduction effects are even more resonant for frozen plan sponsors, who could see their requirements decrease by more than 50% over the short term. Furthermore, by the time interest relief under ARPA begins its wear-away period in the year 2026, the effect for many plans could be muted given the potential for asset build-up over the next five years, assuming that plans meet their return expectations over this period.

Unintended prefunding balance consequences

Retroactive application of ARPA certainly can bring about benefits for plan sponsors. However, care must also be exercised so as to not be left with unintended consequences. Based on good faith interpretation of the relief under ARPA—Internal Revenue Service (IRS) regulations have not yet been issued—it is thought that excess contributions can be used to create prefunding balances. But these balances may not necessarily be available for immediate use in an intended year if the plan does not meet an adjusted funded ratio of at least 80%. Also, while it is possible to create a larger prefunding balance by revising the 2019 plan year valuation, the resulting balance available for the 2021 plan year may not be as large as initially envisioned if a plan sponsor is required to forgo some of the balance.

Mandatory forfeitures are required for plans that have accelerated forms of distribution and the ability to reach 80% funding by writing off some or all of the existing prefunding balance. In addition, by creating a larger prefunding balance based on retroactive application of ARPA, it is possible for a plan to trigger the requirement for a PBGC 4010 filing. This is because the PBGC 4010 filing threshold test requires plan assets to be offset by a plan’s prefunding balance. This would certainly be an undesirable consequence for a plan that had previously cleared the exemption threshold for the PBGC 4010 filing under application of the prior law.

Lastly, as long as a plan has a funded status below 100%, the existence of a prefunding balance actually serves to increase its minimum funding contributions due to the technical rules that must be adhered to in setting up shortfall amortization bases. Therefore, plan sponsors will want to work in concert with their pension actuaries to carefully determine the optimal starting point for the application of ARPA relief (2019, 2020, 2021, or 2022).

Cash contributions and tax deductibility

Funding ratios and projected minimum cash contribution requirements are just one aspect of this multifaceted coin. Clearly, plan sponsors that will strictly fund their plans to the level of minimum cash requirements will not get the benefit of higher tax deductions relative to funding beyond minimum cash requirements. While many plan sponsors have been accustomed to only funding minimum cash requirements in the years leading up to ARPA, due to business or other cash flow constraints, they should reevaluate their funding strategies now given the newly minted relief provisions.

In addition, some plan sponsors may want to redouble their contribution pledges should federal tax policy change. While a record stimulus package was passed under the Biden presidency, there is consternation about how the relief provisions will exactly be afforded. Should U.S. fiscal policy result in corporations being more heavily taxed than under current law, some plan sponsors may choose to begin making larger cash contributions to capitalize on the tax deductions. In fact, we saw this behavior in response to the Tax and Job Cuts Act of 2017 passed during the Trump regime, when plan sponsors accelerated cash contributions just prior to the application of lower corporate tax rates. For reference, Milliman's 2021 Corporate Pension Funding Study reported a plan sponsor contribution spike of $61.8 billion during 2017 compared to $34.6 billion in 2020 for the plans of the largest 100 U.S. publicly traded corporations.1

Benefit restrictions and other triggers

While ARPA did not necessarily change the cost of pension plan funding, it did alter contribution timing. The new funding rules allow longer periods of time for plan sponsors to make up funding deficits. Relative to prior law, this means that pension plan funded percentages will take longer to improve over time on average. Certain funded status thresholds have key importance under pension funding rules and plan sponsors may want to adjust their funding strategies accordingly as they near these thresholds.

For example, plans that are funded below 60% are required to freeze benefit accruals. The changes to interest rate smoothing with ARPA mean that plans that are funded below this mark now have the opportunity get over this hump sooner and with the potential of contributing less than needed under the prior law. The same logic can be applied to plans that are below the 80% and 100% funded status thresholds. Getting above 80% can help plans to avoid imposition of benefit restrictions on accelerated forms of payment such as lump sums. Payment of lump sums can be an important feature in a plan sponsor’s overall de-risking strategy as is discussed later. Funding over 80% could also allow for usage of prefunding balance in lieu of cash contributions in a year where cash funding may present a particular sponsor difficulty. Furthermore, not meeting the 80% funding threshold also carries other consequences. At-risk valuations, for example, could accelerate funding requirements.

Lastly, the 100% funding threshold could be an important consideration when determining a plan’s shortfall amortization base, a key component of a plan’s minimum required contribution, as noted above. The takeaway here is that there may be opportune times for plan sponsors to make contributions above ARPA minimum requirements as their plans near certain key funded status thresholds. Again, this should be highlighted by the plan’s actuary.

PBGC premiums

PBGC insurance premiums consist of a flat dollar premium and a variable rate premium (subject to a cap). The variable rate premium is based on a plan’s funded status, without the reflection of smoothed interest rates as allowed under ARPA. This means that if a plan sponsor chooses to make lower contributions (as allowed under ARPA) then they will often be required to pay a larger PBGC premium. Plan sponsors will need to weigh reduced minimum funding requirements under ARPA with increased PBGC insurance premiums. Under ARPA, plan sponsors have roughly double the time to making up for underfunding relative to prior law, but this would result in paying higher PBGC premiums for longer. Irrespective of the higher insurance premiums, plan sponsor contributions overall will be lower under ARPA, assuming of course that plans meet their annual return expectations. For plans paying PBGC premiums out of plan assets, the premiums are already a factored component of the plan’s minimum required contribution calculation.

Another mitigating factor to consider is the application of the PBGC variable rate premium cap, which is a function of the total number of plan participants. For significantly underfunded plans, as long as the variable rate premium cap applies, plan sponsors are protected from the larger variable rate premiums that would otherwise apply. As a plan’s funded status improves and the plan is no longer subject to the variable rate premium cap, the plan sponsor may want to consider accelerating its funding to lower the overall insurance payment. A common tactic for plan sponsors near full funding on a PBGC basis is to evaluate the benefits of additional funding in order to completely avoid paying a variable rate premium.

Pension accounting expense

While investment returns sharply rebounded and ended the year well ahead of expectations in 2020, discount rates fell sharply. That resulted in a mixed bag for plan sponsors for purposes of determining pension expense in 2021. For plans with longer durations and more cash flows sensitive to interest rates, the drop in the pension discount rates will likely result in a pension expense increase in 2021 relative to 2020. On the other hand, plans with shorter durations may find their liability losses offset by their asset gains in 2020 and thus may experience a reduction in 2021 pension expense compared to 2020. Either way, the one variable component of 2021 pension expense that plan sponsors can still influence is the expected return on assets.

Plan sponsors may want to consider making voluntary contributions in 2021 in order to increase the expected return on assets component of pension expense, thereby lowering the pension expense impact in 2021. Higher pension contributions in 2021 will also help to boost pension funded status as measured at the end of the 2021 fiscal year, which is a determinant for the 2022 fiscal year pension expense. Of course, the reduced funding requirements under ARPA will generally result in an increase in pension expense for sponsors who contribute less cash and/or use prefunding balances. For plan sponsors concerned about the long-term impact on pension expense as a result of the lower projected cash funding requirements under ARPA, multiyear accounting projections should be examined in addition to funding projections.

The passage of ARPA also necessitates the reexamination of pension risk management strategies. The remaining considerations will focus on popular pension risk transfer techniques, which have been rising in frequency over the past decade. Pension de-risking via asset allocation and glide path techniques will also be discussed.

Incentives for de-risking via window programs

Window programs have been used by plan sponsors for decades to accomplish human resource objectives during various business cycles and to meet long-term plan sponsor risk objectives. Windows are required to be voluntary and compliant with nondiscrimination requirements, and they are often executed over a short period of time such as 45 or 60 days (although the entire window administration process will take much longer depending on the extent of employee communications, data quality, and plan complexity). A couple of window strategies that are worth plan sponsor consideration include early retirement incentive windows and lump sum windows.

The COVID-19 pandemic can affect retirement patterns in different ways, including accelerating early retirement in some cases and contributing to delayed retirement in other cases. Employers in certain industries may be facing aging workforces who tend on average to defer retirement to later ages. The pension plan combined with an early retirement window can be used by a plan sponsor as a workforce management tool. Early retirement windows may include pension benefit incentives such as granting additional years of service or lower reduction factors applicable for earlier benefit commencement. Current IRS funding rules under the Pension Protection Act state that if a plan is funded below 80% at the time an amendment is adopted, any additional costs related to that amendment will require immediate funding (instead of amortizing the cost over 15 years as allowed under ARPA). With the extension of interest rate smoothing and the retroactive application of ARPA, the 80% funding threshold may be more in reach for plan sponsors now than ever before to execute window offerings.

Lump sum window offerings also continue to be widely used by plan sponsors in transferring longevity risk onto plan participants, and they don’t come with the hefty premiums associated with third-party liability transfers to insurance companies. In order for plans to pay lump sums without any benefit restrictions, they need to be funded above the 80% level. Similar to the early retirement window narrative, plans may now be in a better position to execute these strategies with the passage of ARPA and the associated higher funding levels.

Another added benefit of window strategies is that they reduce a plan’s participant count, which could result in PBGC premium savings for plans where the variable rate premium is limited by the per participant premium cap. With the slower funding progression expected under ARPA, plans could be limited by premium caps longer than under prior law. Thus, incentive windows can be explored that would bring about additional cash savings to plan sponsors under ARPA.

Asset allocation

With ARPA bringing about transformational funding relief for plans, it is a good idea for plan sponsors to revisit their plan asset allocations to make sure their funding and investment policies are in sync. The relaxed minimum contribution requirements under ARPA allow plan sponsors to take longer-term views toward pension de-risking. As such, plan sponsors may want to take on less risky investments and consider the adoption of liability-driven investment strategies, if they have not done so already. Prior to ARPA, many plan sponsors had significant funded status deficits, and with interest rates steadily declining in 2019 and 2020, the possibility of shifting assets from equities to fixed income may have not have been palatable. Plan sponsors would not want to lock in underfunding by taking on greater fixed income positions, given the cascade of upcoming required contributions that they would have faced prior to ARPA.

With funded ratios immediately improving under ARPA and minimum required contributions significantly muted over the next several years, shifting asset allocations from equities into fixed income seems like a viable alternative again. Many plan sponsors had already been doing this via glide path strategies adopted well before the passage of ARPA. For those plan sponsors, further progression down the glide path toward full funding is very likely to continue.

Pension buyouts and plan termination

Even with the business disruptions caused by COVID-19, pension buyout activity continued to occur in 2020. In fact, the 2021 Corporate Pension Funding Study revealed that pension risk transfers (including pension buyouts and lump sums) for the largest 100 U.S. plan sponsors of defined benefit plans totaled $15.8 billion in 2020, which represented an increase from the $13.5 billion recorded for 2019. While the passage of ARPA will not affect the costs of annuity purchases and plan terminations, the general improvement in ERISA funded status may cause some plan sponsors to reevaluate their pension risk transfer strategies.

With the costs of maintaining a frozen plan significantly decreasing over the next several years due to lower minimum required contributions, some plan sponsors may decide to choose a plan hibernation strategy over annuity purchases and plan termination. Continuing along the pension glide path to full funding and letting the plan run its natural course by paying out benefits to retired pensioners over time can offer cost savings to plan sponsors relative to third-party risk transfer strategies. After the ERISA full funding threshold is crossed, immunization investment strategies can lock in surplus sufficient for the elimination of contributions and the minimization of PBGC premiums. Upon this juncture, a plan sponsor can decide to further ride out its pension plan naturally once the ongoing costs are essentially covered, or terminate the plan depending on its risk and financing preferences. Terminating a pension that is already in a position of funding surplus will certainly be less costly than doing so for a plan with a funding shortfall.

In conclusion, despite the current uncertainty caused by the COVID-19 pandemic, there is renewed hope for defined benefit pension plan sponsors. This article touches on the numerous considerations and pathways for plan sponsors to follow going forward under the passage of ARPA. Every plan sponsor has its own unique set of circumstances to examine under the lens of ARPA. Ultimately, the decisions on whether to proceed with further pension de-risking will depend upon what level of risk is appropriate, including a plan sponsor’s risk tolerance and expectation for the future. We know that the future is a whole lot brighter for plan sponsors now with the passage of unprecedented funding relief under the American Rescue Plan Act of 2021.

This article first appeared May 18, 2021 on Milliman's website at https://us.milliman.com/en/insight/defined-benefit-pension-funding-resurrection#

1Wadia, Z., Perry, A.H., & Clark, C.J. (April 2021). 2021 Corporate Pension Funding Study. Milliman White Paper. Retrieved May 9, 2021, from https://us.milliman.com/en/insight/2021-corporate-pension-funding-study

By Richard W. Rausser, Senior Vice President of Client Services at Pentegra

Although not available until January 1, 2022, for plan years beginning after December 31, 2021, Groups of Plans (GoPs) can reduce administrative burdens and costs. GoPs will probably be even easier to establish than MEPs and PEPs. It’s not too early to start thinking about your role as an advisor to both your existing clients and prospective clients. As an advisor, you know what types of plans your clients have and what their needs are. It may make sense to bring a group of small employers together to form a GoP, or put a new plan into an existing GoP.

Background

The SECURE Act (Setting Every Community Up for Retirement Enhancement Act) of 2019 was designed to make retirement savings easier for employees and the employers who sponsor their retirement plans. SECURE generated a lot of interest as it created a new type of retirement program – Pooled Employer Plans or PEPs – and eased the regulations for Multiple Employer Plans (MEPs). SECURE also provided for a new type of plan called a “Group of Plans” (GoP).

Although not available until January 1, 2022, for plan years beginning after December 31, 2021, GoP provisions are found in Section 202 of the SECURE Act. A GoP is a group of single-employer plans, related or unrelated, whose sponsors have chosen to affiliate with each other. One of the primary reasons to do so is to be able to file a single consolidated Form 5500 and (presumably) conduct a single audit for all plans in the GoP.

Requirements

Section 202 of the SECURE Act specifies that all plans in a GoP must first, be defined contribution plans and second, must have the same:

Trustee

Named fiduciary (or fiduciaries)

Administrator

Plan year

Investments/investment options

Defined Contribution plans

It makes sense that all the plans in a certain group are the same type, and the Group of Plans is no exception. To ensure this, SECURE wrote it into the act. All plans must be single account, defined contribution plans such as 401(k)s.

Same trustee

ERISA (Employee Retirement Income Security Act of 1974) mandates that assets of an employee benefit plan must be held in trust overseen by one or more trustees. The trustee must be named in either the trust document or the plan document, or appointed by a plan fiduciary. The trustee has oversight of the plan’s assets unless that responsibility is delegated to one or more asset managers.

Since all plans in the GoP must have the same trustee, that trustee must be agreed upon by the plans who are forming the GoP and their trust and plan documents amended to reflect that trustee.

Same named fiduciary

Every employee benefit plan must be established and maintained by a written plan document. This document specifies the ERISA section 402(a) Named Fiduciary for the plan, who is the main fiduciary responsible for the plan’s administration. In many cases, this is the employer who sponsors the plan; a different fiduciary can also be named by the plan document. Certain fiduciary responsibilities can be delegated to an ERISA 3(21) investment consultant and even more to an ERISA 3(38) investment manager, but not all.

A GoP is overseen by a named fiduciary who is the same for all plans in the group, so plan amendments will be required to name the GoP fiduciary for each plan.

Same administrator

A plan’s administrator is named by the plan document. If the document doesn’t name an administrator, it’s the plan sponsor. Certain administrative functions can be delegated to an ERISA 3(16) administrator, but not all.

Who will be the administrator for the GoP? Instead of the individual plan sponsors, it will have to be a person or entity agreed upon by the members of the GoP. This could be a possible sticking point since plan sponsors tend to be protective of their plans.

Same plan year

It just makes sense that all the plans in the Group of Plans have the same plan year, beginning on the same date, such as January 1 for calendar year plans. The only exception would be for a short plan year caused by a mid-year plan termination. A GoP would be a nightmare to keep track of if all the plans associated with it had different plan years, if not impossible. After all, one of the main reasons to group together in a GoP is to have a single Form 5500.

The vast majority of defined contribution plans operate on a calendar year basis, so this requirement may not be much of a hurdle. If a plan sponsor with an off-calendar-year-plan wants to join the group, the sponsor will simply need to amend the plan for calendar year status.

Same investment options

All plans in the GoP must have the same investments and investment options offered to their plan participants and beneficiaries. This makes administration and communication among plans easier, not to mention preparation of Forms 5500 for the GoP.

This requirement of the legislation will require plan sponsors to change their investment lineups to be the same as selected for the GoP. This aspect of a GoP is one that will be the most visible to plan participants since they will be directly impacted by the change. Good communication at this stage will be critical for the success of the implementation into the GoP from a single plan arrangement.

Plan design

SECURE doesn’t address plan design for GoPs the way it does for MEPs and PEPs, so each plan sponsor in a GoP can design their plan the way they want, with the features that work best for them and their employees.

Conclusion

The upside to GoPs is the ability to file a single Form 5500 for more than one plan, which can reduce administrative burdens and costs. The downside is that plans are still administered separately, not together as they are with MEPs and PEPs.

GoPs will also probably be easier to establish than MEPs and PEPs, although final guidance hasn’t been issued yet.

However, it’s not too early to start thinking about your role as an advisor to both your existing clients and prospective clients. As an advisor, you know what types of plans your clients have and what their needs are. It may make sense to bring a group of small employers together to form a GoP, or put a new plan into an existing GoP.

It’s all based on individual characteristics and preferences of the plans being brought into the GoP. Some things – like plan design features – can be different, but other things – such as the plan administrator, fiduciary and trustee – must be the same. As must the investments. How much control the plan sponsor is willing to give up could be a sticking point.

Planning and communication will be very important, especially when it comes to the plan investment options. It takes time to approve the plan amendments that will be required.

But first, the key players in the GoP – fiduciary, trustee, administrator – must be determined. How that will happen and how those people or entities will be selected will be specified by some sort of agreement that is part of the GoP setup.

How will all this come about? Stay tuned for guidance that will need to address all these issues. It never hurts, however, to be as prepared as possible if you’re thinking about working with Groups of Plans beginning in 2022.

About the Author

Richard W. Rausser has more than 30 years of experience in the retirement benefits industry. He is Senior Vice President of Client Services at Pentegra, a leading provider of retirement plan and fiduciary outsourcing to organizations nationwide. Rausser oversees consulting, BOLI and non-qualified business development and actuarial service practice groups at Pentegra. He is a frequent speaker on retirement benefit topics; a Certified Pension Consultant (CPC); a Qualified Pension Administrator (QPA); a Qualified 401(k) Administrator (QKA); and a member of the American Society of Pension Professionals and Actuaries (ASPPA). He holds an M.B.A. in Finance from Fairleigh Dickinson University and a B.A. in Economics and Business Administration from Ursinus College.

Richard W. Rausser has more than 30 years of experience in the retirement benefits industry. He is Senior Vice President of Client Services at Pentegra, a leading provider of retirement plan and fiduciary outsourcing to organizations nationwide. Rausser oversees consulting, BOLI and non-qualified business development and actuarial service practice groups at Pentegra. He is a frequent speaker on retirement benefit topics; a Certified Pension Consultant (CPC); a Qualified Pension Administrator (QPA); a Qualified 401(k) Administrator (QKA); and a member of the American Society of Pension Professionals and Actuaries (ASPPA). He holds an M.B.A. in Finance from Fairleigh Dickinson University and a B.A. in Economics and Business Administration from Ursinus College.

The SECURE Act of 2019 has spurred even greater interest in Multiple Employer Plans (MEP), and created new arrangements such as Pooled Employer Plans (PEP), and Groups of Plans (GOP). This popularity has the potential to alter the structure of the Retirement Plans landscape and to transform plan advisor practices.

For advisor teams, the emergence of PEPs presents both a threat and an opportunity. At a recent meeting of the Retirement Advisor Council, Michael Rhim of PRM Consulting, Mark Olsen of PlanPilot, Nichole Labbott of Sageview Advisory Group, and Terry Power shared their perspective. Council members Scott Schlappi and Paula Hendrickson moderated the session.

The SECURE Act stated a specific goal of enhancing the availability of defined contribution retirement plans among small employers. This is integral to the intention of providing access to 401(k) plans for those Americans who can’t participate in such a plan today. However, benefits extend to all employers, not just small business.

PEPs are of particular benefit to current plan sponsors with 100 to 500 employees. Indeed, upon joining a PEP, these employers will no longer need to file a Form 5500 or have an annual plan audit for their own plan. They will also limit their fiduciary responsibility to the selection and monitoring the Pooled Plan Provider (PPP). No longer will they be liable for the selection and monitoring of investment options, or for plan administration.

The benefits of PEPs and other pooled arrangements extend to employers of all sizes and in all industries. This gives plan advisors the opportunity to discuss the characteristics of these new options with current clients, even if (or maybe especially if) the client is not a good prospect for these new options. For example, employers with a strong preference for a custom retirement plan solution and sufficient scale to negotiate preferred services from their recordkeeping service provider wouldn’t be particularly good candidates for a PEP. However, these employers may question the value of their current advisor relationship if they learn about these arrangements from a competing advisor.

Terry Power warns advisors, “Be aware of what is happening in the market because you will get phone calls from clients who have been approached about it.” For this reason, Terry proposed that PEPs present an opportunity for advisors who enjoy educating plan sponsors. ”Educating clients gets us and keeps us involved in the discussion even if it is not the best solution for the client.” Mark Olsen added.

Scott Schlappi pointed out that discussing the practice’s posture regarding PEP plans highlights the difference between cost and value proposition. “If you hear it’s cheaper – it is because your fee is cheaper, it is not because the recordkeeper’s fee is cheaper.” And the situation may be even a bit more complicated. Mark Olsen pointed out that an advisor becoming involved with a PEP plan for multiple clients may actually lose revenue in the short term: “You may get a drop of revenue but some years down the road, it may create larger margins.”

Terry Power replied that “But there is good news too; your cost will go down as well.” For this reason, Michael Rhim recommended that advisors approach MEPs, PEPs and GOPs strategically, to gain the experience that puts them in a position to speak to PEPs with authority: “You have to be strategic about the way you approach the multiple plan market. How you want to structure pricing and service model, because if you don’t have the experience, it puts you behind other advisors who do.”

The strategic approach seems to be the right one. Becoming a PEP advisor doesn’t entail providing soup-to-nuts service to the PEP. There are several roles for an advisor to pick and choose when it comes to their typical involvement in a PEP plan as Mark Olsen pointed out:

Advisors can play different roles in relationship to the PEP. It may take a little introspection on the part of the advisor to determine the best approach. Where is the emphasis or sweet spot for the practice? Is it to be the 3(38) investment adviser, the educator, or a custom portfolio manager?

To select the role an advisor wishes to play with PEPs, Michael Rhim: suggested that advisors ponder three critical and revealing questions:

- Does it make sense for you to be an advisor for a MEP or a PEP?

- How do I deepen my relationships with my clients and discuss with them if a MEP or a PEP makes sense for them?

- What services can I offer to them?

Working in teams may be the best option for an advisor. Nichole Labbott pointed out that “Collaboration has to be in the spirit of what you provide. We are a 3(38) and we pride ourselves in consulting. You have the opportunity to partner with others. Plan sponsors like to hear confirmation from multiple parties (auditor, ERISA attorney, other professionals).” Working in a team with other professionals adds credibility to the services that you provide.

While many plans will have a geographic or regional component in nature, Terry Power suggests that advisors deciding to get involved with PEPs look at their entire block of business and ponder if it makes good sense to set up a proprietary PEP for their client base. Group of Plans (GOPs) will start in 2022. Advisors can create a group of plans that share the same investment trust. For example, they could create a group of plans consisting of clients of a given ERISA attorney. A new frontier may be on the horizon. Advisors will need to educate themselves on what makes the most sense for them and their practice overall. Meanwhile, their clients will keep them on their competitive toes in the ever-changing retirement industry. Is it PEPs, MEPS, GOPs or not?

The Setting Every Community Up for Retir1ent Enhanc1ent ("SECURE") Act, which was signed into law on Dec1ber 20, 2019, is being hailed as the most significant retir1ent savings reform since the Pension Protection Act in 2006.

So what does the legislation mean for plan advisors, service providers and investment managers? Plan amendments, changes in syst1s and procedures, new education and training, and, last, but certainly not least, many, many opportunities to increase plan coverage and savings.

This article highlights eight key actions to be taken to impl1ent and comply with the SECURE Act provisions for qualified defined contribution ("DC") plans, as well as opportunities to discuss with plan sponsors changes in investment line up and other features of their DC plans. Please note that the CARES Act, the coronavirus economic stimulus package, has extended a few of the SECURE Act effective dates, and other effective dates are subject to further delay.

The SECURE Act also provides opportunity to approach 1ployers that have not yet established a plan for their workforce. Here are a few action it1s and suggestions pertaining to the SECURE Act:

- Review with plan sponsors procedures to comply with SECURE Act requir1ents that are immediately effective (amendments to plan documents required by 12.31.2020):

- Eliminate plan credit card loans;

- R1ove restrictions on distribution of lifetime income investment that is no longer authorized to be held in the plan;

- Permit penalty-free, in-service distribution for "qualified disasters", with the ability to recontribute the distribution within three years;

- Permit penalty-free, in-service distribution for "qualified birth or adoption";

- Increase required minimum distribution age to 72 years old (the CURES Act permits waiver of all RMDs to be made in 2020);

- Limit "stretch RMD".

- Review with plan sponsors opportunities for increasing savings and retir1ent security that are immediately available:

- Increase safe harbor cap on automatic enrollment and auto-escalation to 15% for years after the first plan year in which the 1ployee is automatically enrolled;

- Discuss with small 1ployers (up to 100 1ployees) their eligibility for a $500 credit for up to three years, if they add auto-enrollment

- Take advantage of the fiduciary safe harbor for selection of an annuity provider to provide an in-plan annuity investment option, or a lifetime income distribution option.

- Begin discussing with plan sponsors process steps to comply with new requir1ents to take effect in future years:

- Coverage of long-term, part-time 1ployees (mandatory) for plan years beginning Dec1ber 31, 2020, except that for purposes of the new eligibility requir1ents, the 12-month period before Dec1ber 31, 2020 need not be taken into account;

- Lifetime income disclosure: must be added to annual stat1ents furnished more than 12 months after the latest issuance of DOL's issuance of interim final rules providing guidance on a model disclosure or permissible assumptions. Start talking about assumptions, models and how to most effectively build on the disclosure to help participants understand the value of their savings.

- Take advantage of the buzz and seize the opportunities that may arise from the SECURE Act. Advisors and Service Providers should meet with plan sponsors to discuss the various opportunities, new tax credits, changes in plan notices and education delivered to plan participants, as well as impl1entation challenges of the new law. Set up a time frame for making decisions about possible changes. Significant provisions for DC Plans include:

- Increased auto-enrollment caps;

- Addition of lifetime income options as a plan investment and a distribution option;

- Prospective electronic delivery of plan communications once the Treasury proposed rule on e-delivery becomes finalized.

- Start working on syst1 changes, plan amendments and participant notice changes.

- The SECURE Act includes many required changes to plans to increase coverage, to help increase financial literacy of plan participants, and otherwise: